Creditworthiness is a fundamental concept in the world of finance. It is like a key that unlocks access to various resources, such as loans, mortgages, and other credit facilities. Evaluating an individual’s creditworthiness can be daunting. It requires careful credit analysis of many factors, including income, assets, and liabilities. Certain rules have been established to help assessors evaluate an individual’s ability to repay debts responsibly and make the credit analysis process easier.

Several rules have been created to provide guidelines for determining if someone has sufficient financial stability to manage debt responsibly to assist lenders in the evaluation process. Rixloans include assessing factors such as income level and existing obligations and advising on dealing with discrepancies during the credit analysis process.

What Are The Five Cs Of Credit?

The five Cs of credit are like a map that guides one in evaluating creditworthiness. It is an intricate mesh of components with rules and regulations to navigate the terrain successfully.

- Character – This is an individual’s willingness to repay debt obligations, including their credit accounts. Rixloans involves looking at their reliability when meeting payment deadlines and honoring past agreements. It requires closely examining the person’s history, such as any bankruptcies or other delinquencies on their record.

- Capacity – An individual needs more money from wages or investments to cover the amount owed (plus interest) on their credit accounts. Credit bureaus frequently look at current income versus monthly bills and payments before determining if someone handles more debt.

- Collateral refers to physical assets used as security against loans, such as real estate or vehicles. Rixloans items protect lenders. The borrower must default on loan payments for their credit accounts.

- Capital – It examines what financial resources an applicant has available and uses to repay their credit accounts if needed.

- Conditions refers to anything related to a loan request, including economic trends and laws governing lending practices in certain areas for credit accounts.

Evaluating creditworthiness is no easy feat, but by understanding Rixloan’s five core elements, you can make informed decisions about whom you lend your hard-earned money. Navigating Rixloans waters seems daunting, but with proper guidance and knowledge about what makes up a sound financial standing, it can be done without having to be.

Understanding Character In Creditworthiness

Creditworthiness is necessary to evaluate a borrower’s ability to repay debt, and understanding character is required. According to recent data, over 40% of borrowers who default on their loans had bad credit histories before the loan was issued. Lenders must assess a borrower’s character when assessing lending money. Lenders must assess the following four aspects of a character when assessing creditworthiness.

- Trustworthiness

Trustworthiness is crucial when evaluating credit applications. Does the individual keep promises? Are they reliable and responsible with commitments? - Reputation

Reputation plays a significant role in assessing credit applications. What does the borrower’s track record show regarding past financial behavior? Have any warnings or complaints been lodged against them regarding credit reliability? - Repayment capacity

How much income does the borrower generate from work and investments? Do they have enough cash flow to cover monthly payments? Repayment capacity is a critical factor when reviewing credit applications. - Intentions

Is there evidence that suggests how the borrowed funds be used responsibly? Rixloans funds benefit both parties involved in the transaction. Assessing the intentions of borrowers is essential when processing credit applications.

Lenders must assume more than just finances to make informed decisions about granting access to credit. Personal qualities such as trustworthiness and reputation are necessary. Creditors better understand potential borrowers’ intentions and repayment capacity by looking at qualitative and quantitative information. Rixloans’ holistic approach helps create mutually beneficial agreements between lender and borrower while ensuring fair market practices.

Capacity And Creditworthiness

Capacity refers to the ability of an individual or business to repay its debt in full and on time. Capacity is a key factor that must be regarded when evaluating creditworthiness. Rixloans be determined by analyzing financial statements such as balance sheets, income statements, and cash flow statements. Other indicators help determine creditworthiness, including credit card debt, payment history, collateral against loans, and current obligations.

When assessing capacity, lenders must evaluate the short-term and long-term implications of extending credit. For example, suppose a borrower has high liabilities relative to assets. In that case, they need more funds available over the life of the loan. Lenders need to assess if borrowers have sufficient sources of income or liquidity to cover repayment amounts each month, such as through business loans. The overall assessment must provide insight into how likely the lender will receive effective payments from the borrower throughout the agreement term.

Lenders increase their chances of receiving successful payments while providing customers with better finance options, like business loans, by taking Rixloan’s steps before granting credit agreements. To guarantee successful and timely payments, lenders must thoroughly evaluate applicants’ capacity and make informed decisions before granting credit, such as business loans. A comprehensive review of all relevant information helps establish trust between parties and mitigate potential risks associated with lending activities.

Analyzing Capital For Creditworthiness

Capital is the total value of assets and savings at any given time. Analyzing their capital is key when assessing a person or entity’s creditworthiness. Creditors can make more informed decisions when evaluating if they must extend credit terms by understanding an individual’s financial position, particularly when considering a potential customer.

Lenders generally employ various methods to assess an applicant’s capacity to repay debt, such as reviewing the potential customer’s income statements, balance sheets, tax returns, cash flow reports, and other documents related to their finances. Rixloans assessments help lenders determine if applicants have enough resources available to support new borrowing while still being able to meet existing obligations. Further, examining liabilities helps creditors gauge how much more risk is associated with taking on new borrowers.

Individuals must demonstrate adequate liquidity by having sufficient funds for unexpected expenses and obligations to qualify for certain types of loans and credits, such as installment loans. Creditors must evaluate the borrower’s financial health by looking closely at current debts and future repayment capability before extending credit offers. The type of analysis provides required insight into a potential borrower’s ability, or inability, to successfully manage their finances over time.

Examining Conditions For Creditworthiness

It is necessary to examine the conditions of a loan applicant when evaluating creditworthiness, especially for installment loans. Rixloans includes analyzing their capital and other factors such as income and debt. Examining Rixloans conditions indicate how likely an individual is to default on a loan or other financial commitment.

To assess the overall risk associated with a potential borrower, lenders look for indicators that suggest if they are reliable in repaying their debts. Factors like employment history, past payment behavior, and current assets all be used to determine someone’s ability to make future payments.

Further, inquiries into the applicant’s personal life reveal any hidden liabilities or obligations which impact their creditworthiness. Lenders accurately evaluate creditworthiness and better predict repayment behaviors by gathering information from various sources and properly assessing each situation.

Using Collateral To Assess Creditworthiness

Credibility be assessed through collateral. Collateral frequently serves as a required component when evaluating creditworthiness. It assures lenders that borrowers are able and willing to repay their debts. Such as deposits, savings accounts, or real estate properties; applicants demonstrate their commitment to meeting financial obligations on time by utilizing external assets. The value of Rixloans assets is a security measure for creditors in case of defaulting loans or unpaid bills.

Using collateral benefits customers since it gives them access to more affordable loan products with better terms and conditions than unsecured lines of credit requiring higher interest rates due to their riskier nature. Accepting digital forms of payment allows businesses to quickly verify customer credentials without waiting long periods for checks or money orders to arrive. Rixloans makes the process smoother and faster while helping build trust between business owners and clients by providing greater transaction transparency.

Collateral is necessary for assessing creditworthiness as it helps provide more assurance for lenders about borrower reliability while benefiting customers by giving them access to more competitively priced financing options. Understanding how to utilize collateral help both parties secure mutually beneficial arrangements.

How Banks And Lenders Evaluate Creditworthiness

Banks and lenders look at the repayment history of past debts when evaluating a borrower’s creditworthiness. Rixloans includes credit card payments, mortgages, and other loans. The analysis gives insight into how reliable a borrower is regarding loan repayments. Banks and lenders determine creditworthiness by assessing current income levels, assets held, and overall debt obligations. The following are the key methods used to evaluate creditworthiness.

- Assessing Credit History

Banks review an individual’s past payment records from different creditors to check for any negative marks on their financial records, such as late payments or defaults. Rixloans indicate if or not the person has been able to meet their financial obligations in the past. - Regarding Current Income Level

Lenders assess an applicant’s current income level by looking at pay stubs, tax returns, and bank account statements. They determine if the applicant has sufficient cash flow to make regular loan payments. - Evaluating Assets Held

Banks view any available collateral must the borrower default on their loan payments to reduce risk exposure. For example, applicants who own property use Rixloans assets as security against potential losses incurred by a lender due to non-payment of a loan. - Understanding Debt Obligations

Banks must understand other debts borrowers have outstanding before lending money. After accounting for all existing liabilities, they analyze each individual’s debt-to-income ratio and existing lines of credit to understand how much extra borrowing capacity exists. - Examining Credit Score

A good credit score indicates that someone is likely responsible for handling finances. Thus, many banks and lenders regard the factor when contemplating making new loans or extending lines of credit.

Enhancing Creditworthiness Through Good Character

Creditworthiness reflects one’s financial responsibility and ability to meet obligations. It is the currency of trust between individuals, lenders, and banks. Enhancing creditworthiness through good character is required to achieve financial success.

Enhancing creditworthiness begins with understanding how each action affects one’s credit score. Favorable behaviors such as making timely payments, using credit responsibly, or keeping debt levels low help improve scores over time. On the other hand, negative activities such as missing payments or getting too many loans damage your rating. Consider the following to guarantee you maintain good standing.

- Pay bills on time

- Avoid excessive borrowing

- Regularly monitor your credit score

Making wise decisions regarding personal finances requires discipline and perseverance but provides the opportunity for great reward. The journey be challenging, but borrowers who invest the effort reap significant rewards. By investing in yourself today through responsible money management techniques, you are sowing seeds that yield an abundant harvest tomorrow, namely, improved creditworthiness and greater access to capital resources when needed most.

Improving Creditworthiness Through Capacity

Achieving creditworthiness be a challenging endeavor for many individuals. The goal becomes more attainable by taking the necessary steps to improve capacity.

A balanced approach toward budgeting help keeps finances organized and manageable. First and foremost, it is necessary to guarantee that debt levels are controlled. Rixloans means regularly monitoring spending habits to guarantee that only what be paid off easily is taken on. Looking into ways of increasing income or expanding sources of revenue provides an extra cushion when unexpected expenses arise.

Taking Rixloans measures to boost both creditworthiness and overall financial stability over time. Transparency about financial circumstances is necessary to improve one’s credit score. Working alongside creditors in good faith, such as negotiating payment plans, demonstrate a willingness to repay any outstanding debts responsibly. Utilizing available resources from professional institutions like banks or investment firms proves beneficial due to their expertise and advice regarding different options for repayment strategies.

Increasing Creditworthiness Through Capital

Assessing creditworthiness is a required step in any financial decision. The most noteworthy factor to contemplate when evaluating an individual’s repayment capacity is their capital level. Increasing one’s capital is key to improving creditworthiness.

Access to funds is necessary to guarantee that an individual has enough resources to meet their obligations as they come due. Diversifying one’s portfolio by investing in different types of securities offer higher returns on investment while minimizing risk levels. Rixloans include having savings or other liquid assets ready for use.

Owning property, such as real estate or vehicles, help build up capital over time and increase overall creditworthiness. Maintaining good investments, such as stocks and bonds, provides extra sources of income to be used in times of need. Utilizing certain tax deductions and credits allows individuals to keep more money from their earnings, resulting in greater capital being held in reserve.

Rixloans measures not only bolster existing reserves but demonstrate responsibility regarding managing finances. Creditworthiness must assume when looking at potential borrowers. Borrowers with a strong capital foundation are better positioned to manage debt than borrowers with adequate savings or liquidity successfully. Borrowers who successfully increase their capital through Rixloans likely find obtaining loans and favorable terms easier when seeking financing options.

Adjusting Conditions For Improved Creditworthiness

It is a coincidence that one of the fundamental components of financial success and stability, creditworthiness, be improved through conditions adjustments. Various factors, including capital accumulation and debt repayment history, determine creditworthiness. Adjusting conditions to improve creditworthiness is an effective strategy if done correctly. Here are the steps to follow.

- The first step in adjusting conditions for improved creditworthiness is understanding what goes into determining it. Rixloans examines income sources, debts, and other indicators such as payment history or job security. Lenders evaluate potential borrowers based on their ability to repay their loans with interest over time.

- Changing the borrower’s situation helps increase the chances of approval for larger loan amounts or lower interest rates once the information has been collected and analyzed. Rixloans’ modifications include increasing savings or reducing expenses where feasible so that more money is available monthly to make payments without defaulting on any obligations.

- Paying down debts signal good faith from the borrower, which leads to better terms when applying for new financing opportunities.

Making Rixloans adjustments requires patience and diligence but holds great potential for improving financial health overall by increasing creditworthiness. Creating positive ripple effects throughout all areas of life, ranging from housing to education options for families and individuals alike, with greater access to funds comes more flexibility in decision-making.

Leveraging Collateral For Enhanced Creditworthiness

Collateral is necessary to evaluate creditworthiness, as it is used to secure repayment if a borrower defaults. Leveraging collateral effectively requires understanding the value and risk associated with different types of assets. Real estate offers greater security than stocks or bonds while providing lower potential returns. It is necessary to evaluate how certain items change over time and how they impact their ability to be used as collateral.

When assessing a borrower’s creditworthiness, lenders must assess the type of collateral offered and its current market value. Borrowers have an increased chance of obtaining financing at favorable rates by leveraging available collateral appropriately. Lending standards for secured loans are generally more relaxed due to the reduced risk of defaulting on such loans. Lenders even offer better terms if the applicant provides further forms of collateral.

Using collateral in determining creditworthiness has benefitted both borrowers and lenders alike. It assures that debtors honor their obligations without relying solely on a credit rating score or other subjective criteria, thus allowing for improved access to capital for borrowers who otherwise struggle to obtain financing through traditional means. Taking advantage of such opportunities makes all the difference when striving toward financial success.

Utilizing Credit Score To Assess Creditworthiness

Measuring creditworthiness is like entering a minefield but using credit scores. It becomes an easier task. Credit scoring is akin to a GPS for lenders, providing them with a navigational tool that assists in determining if or not they must extend credit to any given customer. It assesses various facets of their financial profile, such as income levels, payment history, and debt-to-income ratio. Rixloans all play necessary roles in evaluating the overall risk of extending credit.

Lenders gain valuable insights into the borrower’s ability to manage their finances responsibly and repay loans on time by analyzing the information from multiple sources. Rixloans helps them make more informed decisions when evaluating loan applications and allows them better to assess an applicant’s potential level of risk. The following points provide further insight into how utilizing credit scores helps assess creditworthiness.

Benefits

Lenders can access much-needed information about potential borrowers’ past behaviors regarding payments and other factors related to their financial records by accessing their credit score, which helps them determine if they pose a minimal or high risk depending on individual circumstances. It gives customers peace of mind when applying for loans, knowing that their chances of approval are higher if they maintain good credit ratings.

Drawbacks

Drawbacks associated with using credit scores for assessment include errors causing inaccurate results due to inaccuracy in reporting data by creditors and lack of transparency around algorithms for generating Rixloans reports despite its many benefits. People without established histories do not benefit from traditional methods, making it difficult for borrowers without sufficient lending profiles to get approved for financing options in certain cases.

Credit scoring provides invaluable guidance when evaluating an applicant’s likelihood of repaying money borrowed over time; regardless, it must be noted that no single factor alone accounts for someone’s entire financial picture, so regarding other aspects is necessary when deciding on if or not someone is deemed eligible for financing opportunities.

Establishing A Healthy Credit History For Better Creditworthiness

A healthy credit history is a key factor in determining an individual’s creditworthiness. A good credit score and report positively influence the ability to qualify for loans, lines of credit, mortgages, and other forms of financing. It helps individuals get better interest rates on their borrowing, resulting in substantial savings over time.

The best way to establish a good credit rating is by making payments on time every month, using no more than 30% of available credit limits, keeping accounts open for longer periods, and avoiding unnecessary debt accumulation. Paying off existing debts helps improve one’s credit standing as it demonstrates fiscal responsibility.

The following are the four main components that need to be addressed when establishing creditworthiness.

- Payment history

- Amount owed

- Length of credit history

- New applications or inquiries into the person’s financial status

Building trust with creditors through reliable behavior, such as paying bills on time and maintaining low balances, helps build an excellent track record that reflects on potential borrowers.

It is necessary to recall that developing positive patterns early in life sets future generations for success when seeking capital investments. Establishing a strong foundation enables individuals to access competitive loan products and services later, saving them thousands in finance costs over their lifetime.

Tips For Improving Creditworthiness

The journey to improving creditworthiness be complex, but with the right tips, it doesn’t have to be. Coincidentally, several ways to improve and maintain good creditworthiness help you on your way. The following guide offers helpful advice for achieving better creditworthiness, from establishing a healthy credit history to regularly monitoring accounts and bills.

First, establish a healthy credit history by obtaining a free copy of your credit report from all three major bureaus (Equifax, Experian, and TransUnion). Review each report for accuracy, as it helps build trust with lenders over time. Further steps include paying down any outstanding debts, providing proof of income when lenders request, setting up monthly payments in advance, and avoiding maxing out available lines of credit.

Next, regularly check your bank statements, monitor bills, or set up automatic payment plans. Rixloans allows you to stay aware of spending habits while ensuring timely payments, which is necessary to build credibility with creditors. Maintaining account balances low on revolving accounts like store cards demonstrates financial responsibility to potential lenders. It is necessary not only to pay off debt but to keep unused open lines of credit since having access without using them shows financial stability.

Taking Rixloan’s measures into contemplation demonstrates an understanding of how money works and respect for creditors who view such behavior favorably when evaluating loan applications. Rixloan’s strategies provide more control over finances and improved chances of being deemed ‘creditworthy’ by future lenders, allowing you to take advantage of previously unavailable opportunities due to poor financial decisions.

Understanding Short-Term Loan Interest Rates: How Much Will You Pay?

Short-term loans provide quick access to funds with a shorter repayment period. These loans have higher interest rates than other financing options, and borrowers need to know the potential costs before taking one out. The table below explores the interest rates for short-term loans, how they are calculated, and provides a warning about the potential dangers of borrowing, according to finder.

| Topic | Information |

|---|---|

| What are short-term loan interest rates? | Short-term loans have an APR (annual percentage rate) typically much higher than other financing options. On average, short-term loans have an APR of around 400%. The APR range from 390% to 780%. The national average APR for credit cards is around 15%. |

| How much will my interest rate be? | The interest rate for a short-term loan depends on how much you are borrowing and for how long. You can use a short-term loan calculator to estimate the rate and costs. Be aware that many short-term loans have hidden overdraft fees that cost over a hundred dollars. |

| How is APR calculated for short-term loans? | APR is calculated by considering the interest rate and any fees associated with the loan. For example, if you take out a $200 loan with a $30 fee and a repayment term of 12 days, your APR would be 456.25%. |

| Warning about borrowing | Short-term loans are expensive, and borrowers must be careful before taking one out. APR rates for short-term loans reach astronomical heights, keeping borrowers deep in debt with their payday lenders. If you struggle to pay bills, explore options like payment plans with utility providers or government benefits. For more affordable options, check out our payday loan alternatives guide. |

Short-term loans are useful for quick funds, but borrowers need to know the potential costs before taking one out. The interest rates for short-term loans are much higher than other financing options, and hidden fees can add up quickly. It’s necessary to explore alternative options and only get a short-term loan if necessary.

The Bottom Line

The process of determining creditworthiness is a necessary step in managing financial affairs. It involves assessing the five Cs of Credit: Character, Capacity, Capital, Conditions, and Collateral. Understanding a borrower’s character by verifying employment history and their debt-to-income ratio reveals much about their ability to repay debts.

Evaluating capital requires reviewing bank statements and other sources of funds available to repay debt. Examining conditions includes evaluating economic trends that affect repayment reliability. Leveraging collateral is necessary if the lender believes the borrower has insufficient resources to meet loan obligations. Utilizing a credit score helps lenders make informed decisions regarding approving or denying loan applications.

Frequently Asked Questions

What factors are considered when assessing an individual’s creditworthiness?

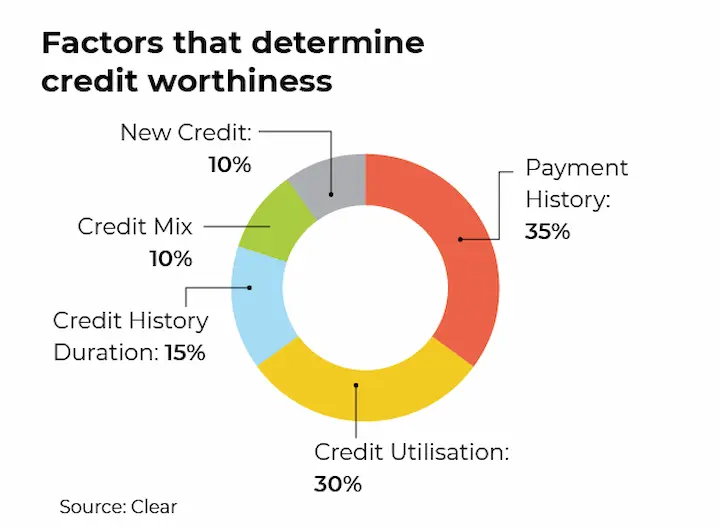

Key factors determining creditworthiness include payment history, amounts owed, length of credit history, credit mix, and new credit inquiries. Lenders also consider income, assets, debts, and stability.

How does a person’s credit score affect their creditworthiness?

Credit scores summarize credit history and strongly indicate creditworthiness. Higher scores signal lower risk and typically lead to increased lending options and better terms. Poor scores equate to high risk.

What role does income play in evaluating creditworthiness?

Income helps determine debt capacity. Lenders verify income to ensure borrowers can repay debts based on the size of loans and existing obligations. Higher, stable income improves creditworthiness.

Can you explain the importance of a borrower’s credit history in determining their creditworthiness?

Credit history provides a record of how well a borrower has managed debts in the past. On-time payments and low balances boost creditworthiness. Missed payments or maxed cards damage it.

What are some common red flags that lenders look for when assessing creditworthiness?

Red flags include bankruptcies, foreclosures, liens, judgments, late payments, high utilization, frequent applications, and short credit history. These signal risk and hurt creditworthiness.