You probably have bad credit due to one reason or another. If this is the case, then you are not alone. A report by the Federal Reserve Board indicates that almost half of the American population has a bad credit score (generally, this is a credit score of below 680).

With such a score, the chances of getting approved for a loan at a traditional financial institution are minimal. So if you need instant cash, the only option is to find an alternative funding source.

In most cases, people who search for online loans end up applying for cash advances.

Almost every state in the US has lenders who provide payday loans. These lenders can be handy when you are in a financial crisis. The best part is that you can qualify for loans even with bad credit.

Rixloans is one of the lenders that don’t perform a hard credit check. You will find on this site payday loans with no credit check. You can qualify for an online loan even with bad credit. Before filling out your application, reviewing the pros and cons of these loan terms is prudent.

What Is A Bad Credit Payday Loan?

An expensive, short-term loan for those with bad credit and bad credit payday loans is available to anyone with less than perfect credit. The term “payday loans for persons with terrible credit” now refers to loans that are repaid over a more extended time but carry high-interest rates, resulting in a high overall payback cost.

A prevalent kind of borrowing, payday loans received much negative attention in the middle of the 2000s. They were intended to be a temporary fix, to be repaid as soon as the borrower receives their next paycheck from their company. The word is becoming more often used to describe a kind of short-term borrowing with high-interest rates.

Do Bad Credit Loans Work?

Payday loans used to be a high-risk, short-term solution for those who couldn’t afford to wait for their next paycheck. A borrower’s wages would then be used to pay back any fees or interest accrued during the loan period.

Many individuals refer to payday loans as long-term, expensive borrowing that must be repaid over months rather than days.

Who Are The Bad Credit Lenders?

Several lenders in the United States are prepared to accept borrowers with bad credit histories. Because of this, it’s not usually the most excellent idea to take out an expensive payday loan with a bad credit rating. Payday loans may be costly, and failing to pay them back on time will harm one’s credit score.

Many direct lenders still care about your credit score. Still, they also want to know whether your current financial and personal circumstances will enable you to make timely and complete repayment of your debt.

Our panel of lenders will determine whether you qualify for a loan based on how closely you fulfill their requirements. You will be matched with a lender from our board who will most likely accept your application if you apply via Rixloans. If you have a negative credit rating, qualifying for a loan through Rixloans may offer you a higher chance of getting the money you need.

Can I get A Same Day Loan?

Getting a payday loan is an excellent choice if you need money quickly. Applying for a payday loan with Rixloans online and receiving your authorized funds within 24 hours is possible, even if you have terrible credit or no credit. An immediate judgment and same-day payday loan financing may be possible if your application is submitted before 10:30 a.m. Eastern Standard Time.

Can RixLoans Guarantee Me A Loan?

Those in dire financial situations often take up payday-guaranteed loans because of the high-interest rates. You can also apply for a $5,000 personal loan with guaranteed approval from Rixloans if you find yourself in a financial bind that needs quick cash (before your next paycheck arrives).

Upon submission of your loan application, you will get a near-instant answer. Online cash advances for adverse credit may be obtained for up to $2,000 and are repayable within a few weeks.

You can generally get a high-acceptance payday loan for a few weeks to a few months. As a rule, your bank account will be debited to pay off the loan.

In California, payday loans are a popular option for those needing quick access to funds. Like other states, California has specific regulations for payday loans to protect consumers.

What Is The Definition of Bad Credit?

Fico uses the following information to come up with individual credit scores;

- Credit mix 10%

- New credit 10%

- Credit history length 15%

- Your debts 30%

- Your payments are 35%

Based on the information, it is clear that your payment history matters more than anything when calculating the fico score. So if you keep missing or making late payments, your credit score will continuously drop. Your credit score will be temporarily reduced if you recently applied for a car loan.

The more you continue applying for credit, the more your credit score will reduce, which will lower your chances of qualifying for affordable advances in the future.

Emergencies happen, which can hinder you from getting a good credit score.

With low credit, it is also true that you may not qualify for better financing. But this does not mean that you are entirely out of options. Some lenders offer credit, and your credit score will improve if you pay it back on time.

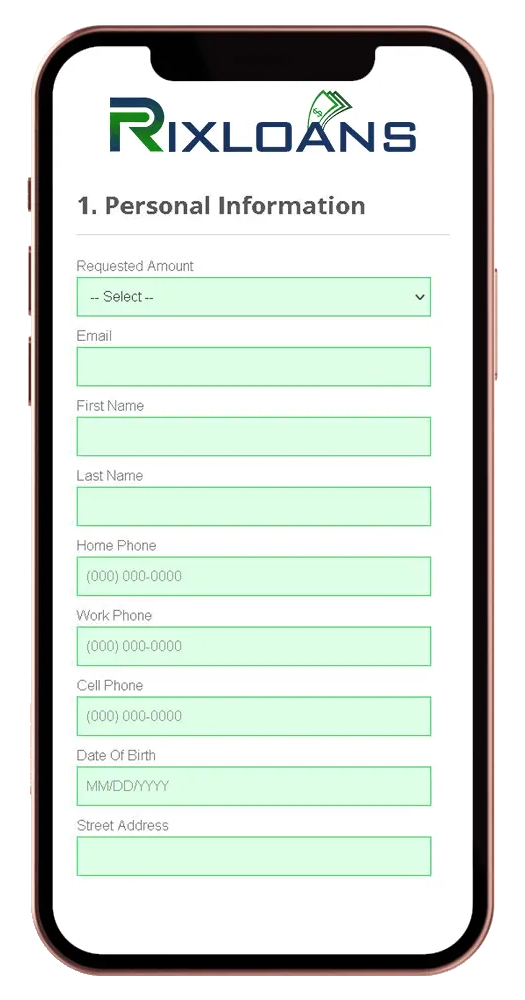

Rixloans is dedicated to safe and affordable payday loans that you can easily apply online using your mobile phone, tablet, or PC.

Other Types of With Bad Credit?

Suppose you are willing to take out an installment loan for many months. The loan amounts are more extensive, and these types of loan offers can be helpful if the repayment period is six months or more. Short-term loans are meant to be paid back by your next paycheck.

What Should I Know Before Applying for a Loan?

- Ensure that the lender is licensed to provide bad credit loans online. Check the company’s reviews online; if possible, you can even inquire about the company’s reputation from friends and family. Rixloans only offers loans in states where we are licensed to operate.

- The lender should be able to approve the funds quickly. If you are applying for a payday loan, you have an issue that needs to be sorted out fast. Consolidation provides instant decision after applying. Our application can be made online, and it can take less than five minutes to apply. If you qualify, the funds are directly deposited into your bank account, and you can get them on the same day.

- The lender should also reward you by reducing the interest rate after consistent total and timely payments. Some lenders will always offer cash with the same rates even when behaving responsibly with the loans.

- Lastly, ensure that the lender has clear terms. Some lenders have a reputation for hitting clients with hidden fee charges. At Rixloans, we will ensure that you understand the contract before signing the dotted lines.

What Are the Loan Requirements?

You can qualify for an online loan for bad credit from Rixloans if you;

- Live in the state where Rixloans operates

- Are at least 18 years old

- Have a reliable source of income

- Have an active checking account

You also should provide your telephone number and email address when applying for our bad credit loans online.

Are There Any Negative Aspects of Taking Out a Bad Credit Loan?

Payday loans are the last option for those with bad credit, but they come with drawbacks. For starters, the interest rates on these types of loans are often much higher than those on other loans. If you take out a loan, be sure you can afford to repay it in full and on time before you do so.

One of the most significant drawbacks of payday loans is that they are supposed to be a short-term borrowing option. As a result, borrowers may face financial difficulties and possibly default if they cannot pay back their debts on time.

Can I Improve My Credit Score To Get Better Loans?

Credit reporting organizations throughout the nation get notifications every time you make a repayment on a loan or credit card. Make all of your payments on time and in total, and you’ll see a boost in your credit score over time as a direct result.

Payday loans for those with terrible credit are no different, and you’ll soon be able to apply for more conventional types of credit, such as credit cards, overdrafts, and even mortgage loans.

What Are the Ways to Boost Your Credit Score?

The higher your credit, the better your interest rates and period options. Maximize your credit score. Check your credit report at AnnualCreditReport.com. Use these techniques to improve your score after you know where you stand.

Be on Time with Your Payments

Your credit may be tarnished even if you have one late payment. Maintain a clean credit record by paying all your debts on time and in full. Enroll in automated payments or set calendar reminders on your phone to avoid missing a payment.

Keep all of your credit cards active.

The duration of your credit history will directly influence your credit score. As a rule of thumb, the longer your credit accounts open and are in good standing, the better your credit score will generally be. Keep your previous tabs open if you can, even if you don’t use them or have a zero balance on them.

Use Less of Your Credit Card Balances

Your credit usage ratio is calculated by dividing your outstanding debt by the total amount of available credit. Because most lenders want a debt-to-income ratio of less than 30%, paying off your debts early and spending less is crucial.

Can I Get a If I Am Unemployed?

Yes! Having a full-time job or putting up security to take out a loan is no longer necessary. These characteristics will not prevent you from taking out a payday loan for bad credit, even if you are currently jobless or on benefits.

An individual’s job and credit history are two of the most important considerations for any direct lender.

You can still make on-time loan payments even if you’re out of work and have low credit. Lenders have the last say on whether or not to lend to you, even if you have other sources of income such as pensions, investments, or savings.

We’re in a great position to assist you in acquiring the loan you need since we only deal with licensed lenders. Complete our loan application, and if approved, the money may be in your bank account as soon as you submit it.

What Are the fees?

When you apply for a bad credit payday loan, you must be aware of three additional fees.

- Origination Fee. An origination fee is a fee your lender subtracts from your loan money as payment for processing your loan.

- Early Settlement Fee. When you pay off your loan early, your lender earns less interest. Your lender can ask for this fee to be paid over as a penalty to compensate for this loss.

- Late Payment Fee. Of course, there is a penalty for not paying on time. Late payment fees can be fixed or depend on the principal loan amount.

At Rixloans, our services are free of charge. We do not add extra costs to your loan for our brokerage services.

What to Do if You Have Too Many Bad Credit Loans?

If you have multiple bad credit loans, you should consider consolidating rather than taking out more. We can provide payday loan debt help with our consolidation loans. If you are in this situation, do not delay, as debt has a habit of spiraling out of control.

Our Team of Expert Writers

Tom Harold Zeus

Personal Finance Writer

Tom Harold is a personal finance and insurance writer who has more than 10 years of experience in covering commercial and personal insurance options. He is also determined to beat her brother, who is a financial advisor with intimate knowledge of the field of personal finance. He devotes time researching the latest rates and rules.

Kimberly Chantal Parkes

Loans Writer

Kimberly Chantal Parkes is a former contributor to Rixloans. Kimberly Chantal is a freelance copy editor and writer with a specialization in personal financial planning. After having graduated from Kansas State University with a bachelor’s degree in journalism, she began her career in media wearing many hats for community newspapers within the Kansas City area: writer as well as copy editor, photographer and coffee runner among other things.

How to Apply a Loan from RixLoans

Application

Apply online using our safe website application process. Upload your application materials in a matter of seconds.

Approval

Once your loan application and supporting documentation have been validated, approval is granted within minutes.

Receive Your Funds

Receiving options include in-branch cash, quick funding to your debit card account, or ACH bank deposit.