Bad Credit Personal Loans Direct Lender

What Is The Difference Between Payday Loans and Online Installment Loans for Bad Credit?

- Payday loans are often modest, ranging from $100 to $500 or less. This might be a few thousand dollars in the case of installment loans.

- Paying back payday loans is typically both financially and emotionally difficult for debtors. On the other hand, installment loans offer a far more flexible and straightforward payback schedule.

- This online installment loan is for 1-2 years or more, unlike a payday loan, which is usually given for 30 days or less to satisfy short-term needs. A payday loan requires you to repay the loan on your next pay period, and the lender accepts your check-in in advance. If you take out an installment loan, you will repay the money in smaller sums over time.

- Unlike payday loans with a relatively lax credit check, installment loans may have a more stringent credit check.

Can I Apply For $5000 From RixLoans?

Yes. Bad Credit Personal Loans of $5,000 are available to all credit types. RixLoans allows you to apply online, regardless of your credit rating. Rixloans has partnered with many reliable lenders who can guarantee personal loans for any credit type.

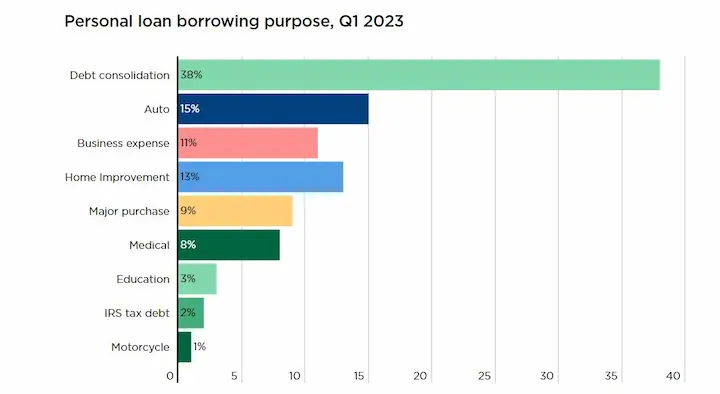

You can use a personal loan for anything, from home improvements to consolidating debt. Personal loans are a popular choice for many borrowers. Continue reading to learn about $5,000 personal loans.

Who Can Qualify for a Rixloans Personal Installment Loan?

A personal installment loan’s qualification standards are based on two critical factors: income and credit. Potential borrowers with poor credit scores may find this intimidating.

The good news is that you don’t have a flawless credit score to be eligible. You must have an active checking account and a valid Social Security Number (SSN). The minimum age requirement is 18, but most people who get loans through us are around 25-35. We also require that you have a steady source of income so we can verify this when processing your loan.

In our commitment to serving the financial needs of individuals, we are proud to extend our services across multiple states in the United States. Below, you’ll find a comprehensive list of American states where our company offers small personal loans for individuals with bad credit, with guaranteed approval for up to $5000. We understand that financial challenges can arise unexpectedly, and we’re here to provide accessible solutions to help you navigate them. Explore our coverage area and discover how we can assist you on your financial journey.

| AL / Alabama | AK / Alaska | AZ / Arizona |

| AR / Arkansas | CA / California | CO / Colorado |

| CT / Connecticut | DE / Delaware | DC / District Of Columbia |

| FL / Florida | GA / Georgia | HI / Hawaii |

| ID / Idaho | IL / Illinois | IN / Indiana |

| IA / Iowa | KS / Kansas | KY / Kentucky |

| LA / Louisiana | ME / Maine | MD / Maryland |

| MA / Massachusetts | MI / Michigan | MN / Minnesota |

| MS / Mississippi | MO / Missouri | MT / Montana |

| NE / Nebraska | NV / Nevada | NH / New Hampshire |

| NJ / New Jersey | NM / New Mexico | NY / New York |

| NC / North Carolina | ND / North Dakota | OH / Ohio |

| OK / Oklahoma | OR / Oregon | PA / Pennsylvania |

| RI / Rhode Island | SC / South Carolina | SD / South Dakota |

| TN / Tennessee | TX / Texas | UT / Utah |

| VT / Vermont | VA / Virginia | WA / Washington |

| WV / West Virginia | WI / Wisconsin | WY / Wyoming |

What Are the Easiest Personal Loans for Bad Credit?

If you have bad credit, don’t worry because there are still many ways to obtain a personal loan, even with no credit history. There are several types of loans available for those who have poor credit:

- A secured loan – This type of loan requires collateral such as a car title, home equity, or other valuable assets. In exchange for this security, the lender gives you a lower interest rate than unsecured loans.

- An unsecured loan – These are the most accessible loans since they don’t require any collateral. However, these loans usually carry higher rates of interest than secured loans.

- A payday loan – Payday loans are very similar to cash advances from a bank. They are typically only good for two weeks and charge high fees.

- Line of credit – Lines of credit allow you to borrow money against future earnings. For example, if you work at a company that offers a 401k plan, you could use your paycheck to pay off a line of credit instead of using your savings.

- A peer-to-peer lending program – Peer-to-peer lending programs let borrowers raise funds from friends and family members.

Where Can I Get a $5000 Loan With Bad Credit?

You should consider your options if you’re looking for a personal loan of $5,000. You may be eligible for the following sources if you have bad credit.

- Online lenders: Online lenders offer quick online applications and fast approvals. You can apply for this loan here at RixLoans.

- Credit unions: Many credit unions offer low-interest loans. Most credit unions are federally insured by the National Credit Union Administration (NCUA), making them safe places to spend hard-earned money.

- Peer-to-peer lending: Peer-to-peer lenders connect borrowers with individuals willing to lend money. Like a traditional lender, borrowers pay directly to individual lenders rather than a third party. Peer-to-peer loans are often more expensive than traditional ones but do not have the same restrictions as payday loans.

Are the Installment Loans Guaranteed?

There is no guarantee of installment loans in the ideal world because various factors are considered before direct lenders give loans with no credit checks. However, because no credit checks are involved, practically everyone has a better chance of getting approved for installment loans from these direct lenders.

What Are Small Personal Loans?

A small personal loan has a fixed term and a relatively small amount. It’s designed to help you cover unexpected expenses, such as medical bills, travel costs, or repairs. Banks, online lenders, and credit unions generally offer small personal loans.

How Much Will RixLoans Charge Me For Bad Credit Personal Loans?

The amount charged for bad credit personal loans depends on several factors, such as loan term, APR, loan amount, etc. However, we recommend you apply for a loan only after carefully reviewing all the terms and conditions of the loan offer. We suggest you compare different offers from various lenders to determine which suits your needs best.

Are There Loans From RixLoans With No Credit Checks?

Yes. To qualify for a personal loan from RixLoans, you don’t have to show good credit for a personal loan. A personal loan should only be considered if you need it or if it will benefit you in some other way, especially if your credit score is low.

Personal loan lenders do not conduct credit checks to make their final decision. You can also use a personal loan to improve your financial situation in the event of unexpected expenses.

You may be able to pay these expenses with a personal loan rather than maxing out your credit card. Even with a poor credit score, a personal loan could be available with lower interest than your credit cards. You should apply for a personal loan with someone to cosign or rebuild your credit.

How Can I Find a Reputable Lender?

- Ask around: This is probably the most crucial step in finding a reputable lender. If you ask around, you can easily find a lender to provide you with a loan. The key here is to ask people you trust. People close to you, such as your parents, siblings, friends, colleagues, neighbors, church members, etc.

- Check out local banks: They are great because they are usually familiar with their customers. They also tend to be less strict about checking your credit score. On the other hand, they might charge higher interest rates.

- Read through customer reviews to see how satisfied they were with the service provided by the lender. Also, read through the comments section to learn whether there was any negative feedback regarding the company. These sites typically collect information from previous clients and then rate the lender based on this data.

- Shop around: Once you have a list of lenders, shop for the cheapest rate. You may have to pay a fee to get an updated quote, so it’s worth doing this before you commit to anything.

What Would Payment Amounts Be on a Loan?

You must know the terms, approved rate, and loan amount to calculate your monthly payment. Personal loans are usually exempt from any early repayment penalties. You can also save interest costs if the loan is paid off sooner than you think. Below are estimates of the estimated monthly payment using different rates and terms.

Can I Repay My RixLoans Loan Early?

In most cases, it is possible to repay a personal loan of $5,000 early. You should ensure no penalties for early repayment before signing up for a personal loan. Don’t be penalized for early repayment or charged extra for repaying the loan early if there is no penalty.

How Long Does It Take for Rixloans to Approve My Loan Application?

Rixloans makes it easy to qualify for a personal loan of $5,000. This site is a secure platform that allows you to submit a straightforward application and receive personalized loan offers in seconds. The initial application will not affect your credit score. Rixloans makes it easy to shop and research while locking in the best rate.

What Are the Pros and Cons of Personal Loans?

Look at the pros and cons of a personal loan for $5,000.

PROS

- Flexible terms and competitive interest rates

- You can use the money for almost anything

- No collateral required

- Fixed monthly payments

CONS

- Taking on debt

- Origination fees

- Some interest rates might be higher than others

What Can a Personal Loan From RixLoans Be Used For?

Rixloans offers a personal loan of $5,000 that can be used for any purpose. A personal loan of $5,000 is an excellent way to consolidate debt. It also allows you to pay less interest and save money.

Personal loans are more common than you might think. They help people pay for various home improvements and other expenses. A personal loan can help you finance home improvements, increasing your home’s value. These are some home improvements that you could get financing for:

Fireplace Installation: A fireplace can be installed in a living or family room to create a more spacious living area and increase the property’s value. On cold winter nights, your family can spend time around the fireplace discussing the day’s events or watching a film.

A mudroom is an addition to your home. This will prevent outdoor messes and dirt from getting into your house. If someone comes in from outside, such as cutting grass, they can quickly clean their clothes and shoes and stop grass clippings from entering other house areas.

You may need new flooring. Normally, you can get some flooring services for as low as $5,000. Fresh paint: Nothing can brighten a space or change the feel of a bathroom or kitchen like a new coat of paint.

You can get interior paint done with a personal loan of $5,000. No matter your home improvement goals, personal loans can help you move those projects from the planning stage to execution.

What Makes RixLoans Different?

Receive Offers in Seconds

Fill out an easy online form to get prequalified for multiple loan offers.

Your Credit Score Won’t Be Affected

Prequalified offers are available with no credit score impact

Flexible Payment Options

Lenders for loans up to $100,000, Terms up to 12 Years; APRs as low as 3.99%

Get Funds Quickly

Sometimes, funds can be received in less than one business day.

Frequently Asked Questions

Is it possible to obtain a $5000 small personal loan with bad credit and guaranteed approval?

Lenders cannot legally guarantee approval. While they may advertise guarantees for bad credit loans, approval still depends on verification of applicant details provided.

What are the typical interest rates and repayment terms for small personal loans with bad credit and guaranteed approval?

Interest rates often exceed 15% APR with terms from 1-5 years for $5000 loans marketed as “guaranteed” for bad credit borrowers. However, approval cannot be assured.

What eligibility criteria or documentation are usually required when applying for such loans?

Even with a claimed guarantee, requirements generally include ID, income verification, bank account info, and references. Basic personal details must still be substantiated.

How quickly can I expect to receive the funds in my bank account after being approved for a $5000 small personal loan with guaranteed approval?

If approved after eligibility verification, funds may be deposited within a few business days depending on the specific lender. Timing varies.

Are there any potential risks or drawbacks to consider when applying for these loans, even with guaranteed approval?

High rates and strict repayment terms are potential downsides. Read all terms closely and make sure you can manage repayment before accepting funds or providing personal information.