There are several ways to improve your credit score, and we’ll get to them in a minute, but nothing will do it more quickly or effectively than paying bills on time and using credit cards responsibly.

What is a Credit Score?

Lenders often use a credit score, a numerical summary of your credit history, to determine how likely you are to repay any loans you get. This is where credit score range comes into play.

Credit scoring models set the range of credit scores from 300 (low)poor credit score to 850 (excellent)excellent credit score. Higher scores demonstrate continuous solid credit histories, including timely payments, little credit utilization, and lengthy credit history. Due to missed payments or overuse of credit, debtors with lower scores may be riskier investments.

Although there are recommendations for excellent and poor credit, there are no precise cutoffs. Most lenders consider scores over 720 to be good and below 630 to be troublesome.

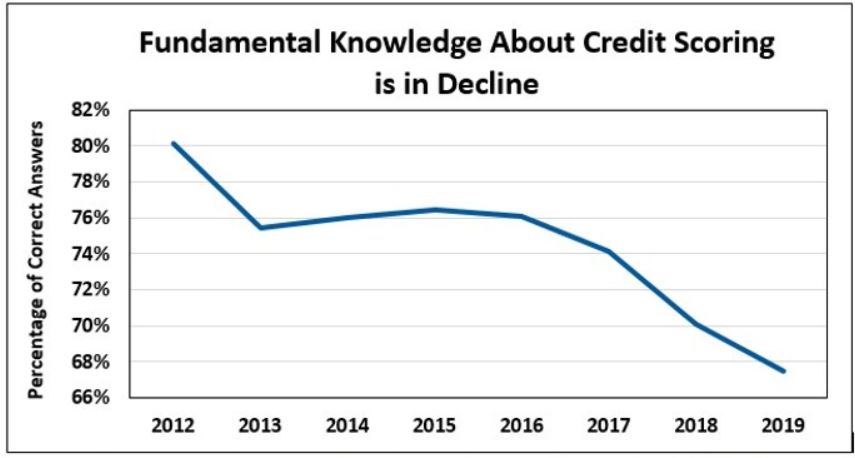

Homonoff’s research proves that consumers are becoming more conscious of how improving their credit scoring factor affects their financial outlook. She discovered that consumers’ purchasing behavior significantly improved when they were aware of their actual credit scores.

She added that many individuals exaggerated their scores after believing they had excellent credit accounts. They realized they needed to start altering their credit practices, so they stopped making late payments, paid off the amount on their credit cards, and their scores rose with the help of major credit bureaus.

90% of companies in the United States base their decisions on a customer’s FICO credit score when deciding how much credit to provide and at what interest rate.

Your credit score is calculated by FICO using a calculation that includes five key factors. These five consist of the following: credit utilization ratio and positive credit history, among others.

- Payment history (35% of the total): Are your payments on time made on time? Do you make the minimum payment, the whole sum, or anything in between?

- Obligations (30%): How much of your available credit do you use? You get a good rating and are regarded as a safe borrower if you only spend 30% of the available credit. Your credit utilization rate plays a crucial role in this factor. If you exceed the limit, you are considered high-risk and subject to punishment.

- Credit history (15%): The longer you’ve had an account, the better it seems to the scorers. Maintaining a strong credit history can positively impact your credit score.

- Credit mix (10%): As long as you can afford them, FICO likes to see various lines of credit like credit cards, mortgages, and auto loans. The entire calculation does not give this category enough weight. Don’t take out a second loan, hoping it will raise your credit score.

- New credit (10%): Opening new accounts sometimes is OK, but doing it often may make you seem risky and lower your credit score. Be mindful of the number of credit inquiries you make, which can impact your credit score. Remember to make your payments on time to maintain a good credit standing.

Your credit rating will vary throughout your life. How consistently you pay off debt, particularly credit cards and installment loans, determines how much it goes. Your bad credit score changes due to increased credit usage, whether using more credit cards, obtaining a mortgage, applying for a student or auto loan, or any other method.

Four Quick Ways to Improve Your Credit Score

There are strategies to raise your credit score if it is below average, some of which provide benefits more quickly than others. Experts share the best ways to improve your credit score fast.

When you have a high credit score, better conditions and cheaper interest rates on loans and credit cards are available. It’s not always simple to instantly raise your credit score, however. You must first consider the reasons behind your poor score and understand the role of Credit reporting agencies in maintaining your credit health.

1. Reduce Your Revolving Credit Card Debt.

One of the effective ways to quickly boost your credit score is to lower your credit card balances. High balances on your credit cards negatively impact your credit utilization rate, which makes up a significant portion of your credit score. Plan to pay off your outstanding balances or at least reduce them to a manageable level.

Additionally, consider seeking professional help from credit repair services. These services can help you in disputing errors on your credit report, negotiating with creditors, and offering guidance on building credit. With their expertise, they can assist you in improving your overall credit health, leading to a better credit score.

Pay more than the required minimum each month if you have the money. Because it helps keep your credit usage rate low, making progress on your outstanding balances may significantly affect your credit file.

According to Triggs, the speed at which individual creditors update the consumer’s credit file to reflect the paid credit card bills will determine how rapidly [your score might increase]. Credit card companies normally submit your credit activity to credit agencies regularly. However, this might vary depending on your issuer. “Other creditors report within days of the payment. Some report at a set period each month.” To discover when your card issuer reports your balance to the bureaus, you may phone or initiate an online conversation with them.

It’s best to set up automatic payments to pay off your monthly payment as quickly as possible. Additionally, you may pay off your amount in numerous installments throughout the month to keep it low and simplify keeping track of your spending. And although paying off even a percentage of your debt is beneficial, doing it in full will have the largest and quickest effect on your credit score.

2. Raise the Credit Limit.

Requesting a credit increase on your present credit card or applying for a new card with better credit products are the two ways to raise your credit limit. If you don’t use your credit card to the maximum each month, your credit usage rate will be lower than your total available credit limit. Make sure you won’t be tempted to spend more than you can afford to pay back before requesting a credit limit increase. Additionally, scheduling automatic payments can help you manage your accounts better and make timely payments for each billing cycle.

Do your homework before applying for a new credit card. Your credit score is affected by how often you use it for new accounts and open existing ones. Each application results in a hard inquiry on your credit report, which lowers your credit score by a few points and requires the card issuer or lender to request your credit report. Consulting with credit repair companies can assist you in making better credit decisions and have a noticeable impact on your overall financial health.

According to Triggs, the benefits of lowering your credit usage ratio to your score usually outweigh the negative effects of those characteristics. Just be careful to avoid raising a red signal to issuers by quickly applying for too many credit cards. This can lead to poor credit habits and further damage your credit score.

Doing your homework before applying for new loans is more crucial than ever since issuers can have harsher terms and conditions as a result of the economic effects of the coronavirus. Beforehand, find out what your credit score is. Consider applying for a secured credit card as an alternative option to help build or repair your credit.

Most top rewards credit cards only accept applicants with strong or exceptional credit, but certain cards are for individuals with less-than-perfect credit. Petal® 2 “Cash Back, No Fees” Visa® Credit Card applicants with no credit history are eligible to apply and have no annual fee. Your credit history is taken into consideration throughout the application procedure. Fair credit or mediocre credit is accepted for the Capital One QuicksilverOne Cash Rewards Credit Card, which pays 1.5% cash back on all transactions.

One type of credit product that can help build or improve your credit is a credit builder loan. Typically offered by credit unions, these loans are good for those with no or poor credit history. You can establish a positive history and improve your credit score by making on-time payments.

3. Verify the Accuracy of Your Credit Report.

Examining your credit record for any mistakes that might hurt your score is one strategy to raise it quickly. If you are successful in disputing them and getting them eliminated, your score can go up.

It’s crucial to examine credit reports for errors since around 25% of Americans have a mistake. Misreported payments and duplicate or fraudulent credit card accounts are frequent mistakes to watch out for. If you find any errors, you can dispute them with the credit bureaus or work with a credit union to resolve them.

4. Request the Removal of Bad Items From Your Credit Record That Have Been Paid Off.

Your credit record may indicate a pattern of missed payments from you or still reflect an already settled old collection account. Ask to have them taken away if this is the case. (If you have an unpaid collection account, take care of it immediately since it might cause a negative impact on your credit score.)

Paying off your debt on time is crucial, as it signals your commitment to a potential lender and could improve your chances of getting better credit terms in the future. However, if you’ve been a risky borrower in the past, turning your credit into debt might happen again, so managing your finances wisely is essential.

This stage could need more time and work from you, but it might be worthwhile. To remove a paid-off account from your credit report, Triggs advises contacting the collections company, debt buyer, or original creditor (depending on who is now handling your account). Consider applying for a secured card to boost your credit rating more quickly.

As opposed to the original creditor, he asserts, you “would most certainly have greater outcomes utilizing this strategy with collection agencies or debt purchasers.”

According to Triggs, having even a settled collection account or paid charge-off on your credit record may discourage lenders from ever extending you more credit. Try to persuade them to delete the account entirely rather than mark it as paid since this might considerably affect your credit score. A rule of thumb is to avoid any material error that could have the biggest impact on your creditworthiness.

How Much Time Does Credit Repair Take?

The average time for your credit score to alter noticeably is three to six months of positive credit conduct. Unless the bad information on your credit report was a little blip, like being late with a bill payment one month, it is tough to make a change any quicker. However, consistently working on your credit over time can help improve your score.

While a timeline for credit repair is hard to specify, it is fair to assume that the less bad information you have on your report—such as missed payments, maxed out credit cards, frequent credit applications, bankruptcy, etc.—the simpler it will be to improve your credit score. Seeking the assistance of a credit counselor can also guide navigating through various financial products and improving your credit situation.

A negative credit score needs additional time to be repaired than a good one does to build. Errors lower your credit score and increase the likelihood that you won’t get a loan. Even if there are lenders that give loans to risk borrowers with terrible credit, borrowing with them results in higher interest costs of hundreds or even thousands of dollars. Additionally, having bad credit might make it difficult to find a job, set up utilities, or even rent an apartment due to negative factors such as unpaid rent payments and defaulted bank accounts.

If you miss one payment, you won’t lose nearly as many points as if you fall behind for many months to the point where your account goes to a collection agency. Your score will represent how much more serious the second circumstance is than the first, especially if you’re going month to month without catching up on your debts.

The Following Timelines Are for Unfavorable Information That Lowers Your Credit Score.

- Your credit record has an overdue account for seven years.

- Repossession of a vehicle remains on your record for seven years.

- Your report will reflect a Chapter 7 bankruptcy for ten years. There are seven years left in Chapter 13.

- Inquiries about credit applications are kept on your record for two years.

- Property liens and other things of public record are shown on your report for seven years.

- Remember that the harm to your credit score is less severe with time. As a result, a Chapter 13 bankruptcy, for instance, has less effect in Year Six than in Year One.

How to Quickly Improve Your Credit Score?

Take a Look at Your Credit Report.

Start by looking into and removing any unfavorable information from your credit report. Such things are certainly conceivable. Additionally, consider applying for additional credit or seeking extra credit opportunities to enhance your credit profile. Remember the importance of average credit age while applying for new credit, as it can impact your overall credit score.

Request a free copy of your credit report. Experian, TransUnion, and Equifax are the top three credit reporting companies, and you are assigned one each year. One of every five credit reports has mistakes or omissions that may harm your score. Vehemently contest each incongruity; provide copies of your assertions.

Investigate “pay to delete” for accounts collected, a technique for getting inaccurate information from records by settling with the company managing your bad debt. Before sending any money, have the agreement in writing.

Send ” goodwill ” letters to creditors with whom you’re experiencing trouble, send “goodwill” letters. Goodwill letters are often brief, straightforward, kind inquiries that urge lenders to delete bad notes. Creditors are not required to comply, but you could get lucky, particularly if your history with the firm has just a few hiccups overall.

Frequently Asked Questions

What are the fastest ways to boost my credit score in a year?

Paying down balances, disputing errors, becoming an authorized user, and not missing payments can boost scores in a year.

Is it better to pay off credit card debt or open a new line of credit to improve my credit score?

Paying down credit card debt improves your credit utilization ratio which has a major impact, so focus on paying balances first.

What steps can I take to remove negative items from my credit report?

You can dispute inaccurate information in writing with credit bureaus or wait for negative marks like late payments to fall off after 7 years.

How does the length of my credit history impact my credit score, and how can I improve it?

Longer credit history demonstrates responsibility over time. Keep old accounts open and maintain solid payment history.

What are some common mistakes to avoid that can negatively affect my credit score?

Paying late, high balances, applying for too much credit at once, and closing old accounts can hurt your credit score.