This indicator determines the loan services you can use and the interest you pay. FICO and VantageScore, both credit scoring models, use a scale of 300 to 850. How to find the best personal loan online, and how many points do you need to qualify for this popular form of credit?

Personal Loans and Scores

These loans do not require collateral. Usually, the funds can be used at the borrower’s discretion. Common goals include covering medical bills, consolidating other debts, and funding special events. The typical range is between $ 1,000 and $ 10,000. Most people who apply for personal loans for bad credit get $5000. Each lender, among various personal loan lenders, has its own vision of an acceptable score, often based on the potential borrower’s credit history and credit report.

When submitting a personal loan application, it’s crucial to know the minimum credit score required by different lenders, as well as their specific credit requirements. Knowing these factors, you can explore various personal loan options and find the best fit for your financial needs.

If your total is too low, your application will fail, or your interest will be high. Lenders interpret bad scores as an inability to meet their financial obligations. This impression is not always correct because the calculation can be distorted by factors like payment history and inaccurate information from credit bureaus.

On average, one in five Americans has a poor credit score because of errors in their credit profile or official reports. The best credit repair agencies of 2022 are part of a big industry. They help consumers improve their scores by addressing issues like credit limit and credit score requirements through litigation. Millions of US citizens use these services yearly to boost their chances of credit approval.

First of all, check your score for free. You can do this on My FICO or apps like Credit Sesame. Then collect the reports and check them against your financial history. This will give your score an instant boost. If there are any mistakes, a good credit repair company will fix them for you.

How Many Points Do I Need?

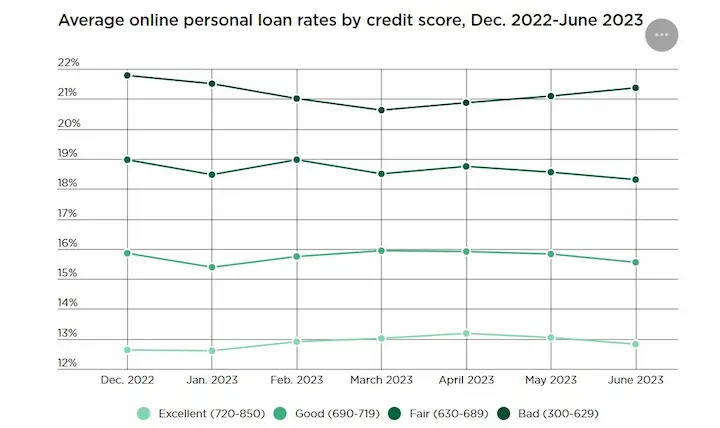

Requirements vary. The Experian agency recommends staying in the 670-739 range for best results. The higher, the better, but lenders do not price products for the best category (“excellent credit“). This means that 800 points unlock the best possible conditions. According to other sources, the minimum credit score requirement is between 610 and 640.

Benefits of a High Score

All lenders check metrics to assess applicants. Your total is a universal barometer of reliability. It depends on loan records stored by major credit bureaus such as Experian, Equifax, and TransUnion. Both assessments (FICO and VantageScore) consider your past payments, credit utilization ratio, the total amount owed, and other factors.

When the score is high, more institutions are ready to accept you, and they offer more attractive terms (interest and fees). All in all, borrowing is cheaper for those with favorable loan terms. They have a wider range of options. Additionally, having a strong credit history will grant you lower annual percentage rate and smaller monthly payments.

The position of financial institutions is understandable. Why lend to someone who doesn’t pay off their debts? These applicants, if accepted, are charged more to offset the risk of default. Now let’s dissect the factors affecting your score.

Factor 1. Previous Payments

How you’ve handled debt in the past affects the largest share of FICO and VantageScore – 35% and 40%, respectively. Positive status requires making time payments on time under the loan agreement. Even a single missed payment can lead to a drop in score. Late payments and the type of loan option chosen can also impact your credit score.

Factor 2. Limits vs. Balances

Your credit cards set your usage rate, also known as the credit utilization rate. It shows how much of your available credit is in use. The higher it is, the less attractive you are to new lenders. To find the ratio, divide your total balances by the total limits. Lenders typically prefer an average credit score, while a bad credit score could be a disadvantage. Borrowers with credit scores should be aware that their credit score matter when applying for loans.

Suppose four cards give you access to $10,000. An outstanding balance of $4,000 means you use 40% of the funds. This is more than what experts recommend. Some sources suggest that the best results start at 10% and lower. This factor determines one-third of your FICO score.

Factor 3. Age of Your Records

The more experience you have as a borrower, the better the score. As long as you make all payments on bills on time and avoid overuse, duration is in your favor. A fair credit history implies a mix of positive and negative accounts. To cater to credit borrowers, the valuation models consider the oldest and most recent accounts and their average age, along with recent credit inquiries. Maintaining a healthy credit score depends on how you manage your accounts; this affects 15% of the FICO assessment.

Factor 4. Credit Mix

Consumers with excellent scores generally have experience with various forms of borrowing, catering to extemporaneous Lender Requirements. For example, your history might include student loans, car loans, mortgages, credit cards, etc. Different types of credit products impact lending decisions, helping determine if you are a responsible borrower. This factor defines 10% of your total.

Factor 5. New Accounts

Opening new accounts can initially negatively impact your score, but as time goes on, maintaining a balance between paying on time and keeping utilization low will result in a strong credit score. It is vital to manage new account openings strategically and ensure you understand how your credit score can be affected.

The remaining 10% depends on recently opened accounts and the number of serious inquiries. These are special entries on your report. They appear whenever a financial institution checks the records. Too many new accounts and apps are hurting your score.

Other Possible Factors

The score is important, but it is not the only requirement. Your income and employment status can also affect your eligibility. The institution may require the latest pay stubs, income tax returns, or other documents proving your creditworthiness. Proof of income is essential during the application process.

Income requirements play a significant role in influencing your chances of approval. Savings and other sources of income are taken into account. Personal loan approval is granted to applicants who meet the eligibility requirements, including those who receive investment income, a pension, or a disability award. Repayment terms are decided based on these factors, and it’s crucial for applicants with credit scores to be aware of these aspects.

Prevention Is Better Than Cure.

Before applying for a loan payment, check your score and borrowing history. Go to www.annualcreditreport.com to download information from the three rating agencies: Equifax, Experian, and TransUnion. This is crucial as the bureaus compile reports independently. They don’t share information, and lenders can liaise with one of the agencies.

Experian recommends doing this well in advance – between 6 months and a year before you apply. Raising the score is doable, but it takes time. Going from “average” to “good” is easier than going from “poor” to “very good.” Making timely payments and reducing monthly debt payments can improve your chances of securing a fair credit loan with the lowest interest rates.

Should We Opt For More Accessible Loans?

Consumers considered a risky borrower and do not obtain personal loans can turn to other, more accessible forms of loans. For example, payday lenders are notorious for accepting applicants with poor track records. The main drawback is the cost.

These loans have outrageous APRs – hundreds of percent a year! This is a short-term solution until your next payday. In reality, this is not true for all borrowers. Therefore, think twice. If possible, improve your credit score and seek attractive borrowing terms with lenders that offer a decision within minutes.

The tips in our article will help you achieve the necessary result. Instead of going for higher-rate loans, work on your score. Make your payments on time, work on your credit usage, etc. It won’t happen overnight, but it will help you avoid the vicious cycle of debt.

(Devdiscourse journalists were not involved in the production of this article. The facts and opinions appearing in the article do not reflect the views of Devdiscourse, and Devdiscourse assumes no responsibility in this regard.)

Frequently Asked Questions

How does my credit score affect my eligibility for a personal loan?

The higher your credit score, the better chance of qualifying for a personal loan with lower interest rates and more favorable terms from lenders.

What is the minimum credit score required to qualify for a personal loan from most lenders?

Many lenders require a minimum credit score in the fair to good range between 580-670, though a score over 700 is ideal for the best rates.

Can I get a personal loan with a bad credit score, and if so, what are my options?

Yes, you can get a personal loan with bad credit, but your options are limited to lenders specializing in subprime borrowing at much higher interest rates.

Do different lenders have different credit score requirements for personal loans?

Each lender sets their own minimum credit score for approval based on their underwriting policies, so requirements can vary.

What steps can I take to improve my credit score to increase my chances of getting a personal loan?

Pay all bills on time, lower credit utilization, correct errors on your report, and avoid new credit inquiries to help improve your credit score.