Merchant cash advances (MCAs) are an increasingly popular form of business financing that has become a mainstay for small businesses across the globe. Offering fast access to capital, MCAs provide entrepreneurs with the flexibility and resources they need to expand their operations and take advantage of new opportunities. Understanding how merchant cash advance work helps business owners identify if it is right for them. The following article explores what merchant cash advances are, how they differ from other types of business financing, and the benefits and drawbacks associated with using them.

Summary

- Merchant Cash Advances (MCAs) are a popular form of business financing for small businesses needing quick access to capital, with repayment based on a percentage of future sales.

- MCAs are a form of alternative financing for businesses not qualified for traditional loans or needing cash.

- Benefits of an MCA include quick access to cash, no collateral required, flexible repayment terms, no fixed monthly payments, eligibility for businesses with poor credit scores, and unrestricted use of funds.

- Eligibility requirements for an MCA vary but generally include a minimum time in business, monthly revenue, type of business, and payment processing.

- Business owners must only use MCAs as a short-term solution for cash flow needs and seek other financing options for long-term financial stability.

What Is A Merchant Cash Advance? How Does It Work?

A Merchant Cash Advance (MCA) is a type of business funding in which a business receives a lump sum of money in exchange for a portion of its future sales. It is a form of alternative financing used by businesses that have difficulty qualifying for traditional loans or have an immediate need for business funding.

A merchant cash advances provider, such as a finance company or online lender, gives a business owner a lump sum of cash. The business owner agrees to repay the advance, in exchange for a fee, by allowing the provider to deduct a percentage of their daily credit card sales or bank deposits. The repayment period ranges from 3-12 months, depending on the terms of the agreement.

The amount a business qualifies for is based on its monthly revenue, and repayment terms are based on the provider’s assessment of the business’s ability to repay the advance. Since the provider is buying a portion of the business’s future revenue, there is no fixed interest rate, and the fee for the advance varies widely depending on the provider and the terms of the agreement. Short-term financing options like these can be helpful in a pinch.

It’s best to note that merchant cash advances are more expensive than traditional financing options. Hence, reviewing the terms and fees before accepting an advance is best. Businesses must only use MCAs as a short-term solution for cash flow needs and seek other financing options for long-term financial stability.

Benefits Of A Merchant Cash Advance

Many business owners opt for a Merchant Cash Advance (MCA) because it gives them the desired results. For example, a business need to quickly purchase inventory, invest in marketing campaigns or cover unexpected expenses. This type of short-term financing can be especially beneficial in these situations.

An MCA provides the necessary funds quickly, within a few days, allowing the business to take advantage of opportunities that otherwise be missed. The flexible repayment terms of an MCA, which are based on a percentage of the business’s daily sales, help businesses manage their cash flow and reduce the risk of default.

Merchant cash advance companies are known for offering flexible repayment schedules, among the key advantages of an MCA, which enables businesses to better manage their financial obligations without putting too much strain on their resources.

Overall, the benefits of an MCA lead to positive results for businesses, such as increased revenue, improved cash flow, and growth opportunities. Listed below are the benefits of MCA to better help business owners understand how it helps them.

- Quick access to cash – A merchant cash advance provides businesses with the funding they need quickly. The application process is simple and fast, and businesses receive funding within a few days.

- No collateral required – Unlike traditional loans, A merchant cash advance doesn’t require collateral to secure the funding. It is a significant advantage for businesses that don’t have assets to offer as collateral.

- Flexible repayment – A merchant cash advance repayment is based on a percentage of the business’s daily sales. It means businesses only pay back the advance when they make a sale, helping them manage their cash flow. Moreover, it offers flexible payment options, enabling businesses to choose the mode that suits them best.

- No fixed monthly payments – The repayment is based on a percentage of sales. There are no fixed monthly payments. It is beneficial for businesses that have fluctuating sales volumes.

- Bad credit is not a problem – Businesses with poor credit scores can still qualify for a merchant cash advance. Providers focus more on the business’s monthly revenue than credit score when determining eligibility.

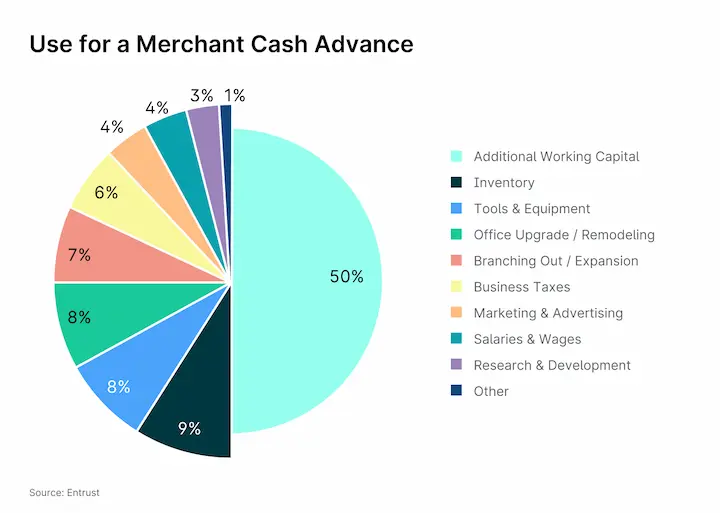

- Use of funds is unrestricted – Businesses use the funds from a merchant cash advance for any purpose. It includes inventory purchases, equipment upgrades, marketing campaigns, or other business-related expenses.

When it comes to supporting businesses in their financial endeavors, RixLoans is dedicated to providing accessible solutions. Below, you’ll find an extensive list of American states where our company actively offers Merchant Cash Advance services. If you’re a business owner seeking a flexible funding option to fuel your growth, refer to the table to discover if our services are available in your state.

| AL – Alabama | AK – Alaska | AZ – Arizona | AR – Arkansas |

| CA – California | CO – Colorado | CT – Connecticut | DE – Delaware |

| DC – District Of Columbia | FL – Florida | GA – Georgia | HI – Hawaii |

| ID – Idaho | IL – Illinois | IN – Indiana | IA – Iowa |

| KS – Kansas | KY – Kentucky | LA – Louisiana | ME – Maine |

| MD – Maryland | MA – Massachusetts | MI – Michigan | MN – Minnesota |

| MS – Mississippi | MO – Missouri | MT – Montana | NE – Nebraska |

| NV – Nevada | NH – New Hampshire | NJ – New Jersey | NM – New Mexico |

| NY – New York | NC – North Carolina | ND – North Dakota | OH – Ohio |

| OK – Oklahoma | OR – Oregon | PA – Pennsylvania | RI – Rhode Island |

| SC – South Carolina | SD – South Dakota | TN – Tennessee | TX – Texas |

| UT – Utah | VT – Vermont | VA – Virginia | WA – Washington |

| WV – West Virginia | WI – Wisconsin | WY – Wyoming |

Eligibility Requirements For A Merchant Cash Advance Contract

The eligibility requirements for a Merchant Cash Advance Contract (MCA) are not the same and vary depending on the provider. Business owners have to review the requirements of different providers and seek professional advice, if necessary, before applying for an MCA. One important aspect is the provider’s access to capital funds. Listed below are the general requirements that businesses must expect, including the availability of capital funds in their MCA contract.

- Time in business – Providers require businesses to have been in operation for at least 6-12 months before they apply for a business cash advance MCA.

- Monthly revenue – MCA providers require businesses to have a minimum monthly revenue of $5,000-$10,000. The advance amount that a business qualifies for is generally based on its monthly revenue.

- Credit score – A poor credit score won’t necessarily disqualify a business from getting an MCA. Providers only check the business owner’s credit score as part of the application process.

- Type of business – Certain providers restrict the businesses eligible for an MCA. For example, they do not fund businesses in certain industries, such as gambling or adult entertainment.

- Payment processing – Providers of MCAs, including Merchant cash advance pros, require businesses to have a minimum monthly credit card sales volume. The repayment is based on a percentage of daily sales.

- No open bankruptcies or tax liens – Certain providers require businesses to have no open bankruptcies or tax liens before they approve them for an MCA.

How To Get Approved For A Merchant Cash Advance

A merchant cash advance is a business funding option for businesses needing quick capital access. It is based on future credit card sales, unlike traditional loans. The advance provider buys a portion of the business’s future sales at a discounted rate. Business owners considering applying for a merchant cash advance must know how to increase their chances of approval. Listed below are the steps to increase their chances of getting MCA.

- Determine if a merchant cash advance is the right fit for the business. It’s necessary to assess if a merchant cash advance is the best option for the business. Check factors such as the cost of the advance, the repayment terms, and the business’s cash flow.

- Have a solid plan for using the funds. Certain lenders want to know how the borrowers plan to use the funds and how it benefits their business. A clear plan demonstrates that borrowers are responsible and serious about their business.

- Provide financial statements. Many lenders want to see financial statements, such as profit and loss statements, bank statements, and tax returns. The documents help the lender determine if the borrower is a good candidate for an advance.

- Have a good credit score. A good credit score shows that the borrower is responsible and more likely to repay the advance. A merchant cash advance is based on future sales. However, many lenders still look at the borrower’s credit score to determine their creditworthiness.

- Have a stable business. Lenders want to work with businesses with a proven success track record. Having a stable business that’s been operating for several years increases the chances of getting approved.

- Be prepared to negotiate. The terms of a merchant cash advance are negotiable, like any loan or funding option. Borrowers must prepare to negotiate the advance terms, such as the amount, repayment terms, and cost.

Understanding The Costs And Fees Of A Merchant Cash Advance

A merchant cash advance (MCA) is a type of financing that provides businesses with a lump sum of cash in exchange for a percentage of their future credit card sales. It is a useful tool for businesses that need quick access to capital. Still, it’s necessary to understand the costs and fees associated with it before accepting an MCA offer. Here are the key factors to know about the cost of MCA.

- Factor rate – Instead of charging an interest rate, MCA providers charge a factor rate. This fixed fee is applied to the advance amount. The factor rate range from 1.1 to 1.5, according to Fundera. But it depends on the provider and the risk associated with the business.

- Holdback percentage – MCA providers require a percentage of each day’s credit card sales as repayment, called the holdback percentage. According to _ Choco Up , the holdback percentage ranges from 10% to 20% of daily credit card sales, according to _Choco Up.

- Repayment term – The repayment term for an MCA is short, just three to 18 months. But the repayment term varies depending on the provider and the terms of the agreement.

- Fees – MCA providers charge extra fees, such as origination, application, and underwriting fees, apart from the factor rate and holdback percentage. The fees add up quickly, so it’s best to read the terms of the agreement carefully and understand all the associated costs.

- APR – MCA is not a traditional loan. Unlike a traditional loan, it has no annual percentage rate (APR). But certain providers still provide an estimated APR to help borrowers understand the cost of the advance.

- High cost – MCA financing gets more expensive than other types of financing, with effective APRs that are over 100%. It’s best to check the costs and fees before accepting an MCA offer and to explore other more affordable financing options.

| Factor Rate | Holdback Percentage | Repayment Term | Fees |

|---|---|---|---|

| 1.1 | 10% | 3 months | Origination fee: $500 |

| 1.3 | 15% | 6 months | Application fee: $250 |

| 1.5 | 20% | 12 months | Underwriting fee: $1,000 |

Below are some types of business loans and their loan terms:

- Short-term loans: Factor rate of 1.1, holdback percentage of 10%, repayment term of 3 months, and an origination fee of $500.

- Intermediate-term loans: Factor rate of 1.3, holdback percentage of 15%, repayment term of 6 months, and an application fee of $250.

- Long-term loans: Factor rate of 1.5, holdback percentage of 20%, repayment term of 12 months, and an underwriting fee of $1,000.

- Scenario 1 – A business operations needs quick access to capital of $100,000 and gets an MCA from Provider A with a factor rate of 1.1, a holdback percentage of 10%, and a repayment term of 3 months. The provider charges an origination fee of $500, which helps in quick funding for the business.

- Scenario 2 – Another business needs $200,000 and decides to get an MCA from Provider B with a factor rate of 1.3, a holdback percentage of 15%, and a repayment term of 6 months. The provider charges an application fee of $250. This supports their business operations and provides quick funding.

- Scenario 3 – A third business needs $300,000 and decides to apply for an MCA from Provider C with a factor rate of 1.5, a holdback percentage of 20%, and a repayment term of 12 months. The provider charges an underwriting fee of $1,000. This choice caters to business operations and ensures quick funding.

Explanation: The table provides information about the key factors to weigh when choosing an MCA, including the factor rate, holdback percentage, repayment term, and fees. Each scenario represents a business that needs quick access to capital and chooses a different MCA provider with varying terms and fees. The scenarios demonstrate how the factor rate and holdback percentage affect the total cost of the MCA and how the fees add up quickly.

Risk Factors To Consider Before Applying For A Merchant Cash Advance

Merchant cash advances (MCAs) are a useful financing tool for businesses needing quick capital access. But they have several risks that businesses must know before accepting an MCA offer. The biggest risk of MCA is the high cost compared to other types of financing, with effective APRs that are over 100%. The short repayment term and holdback percentage impact cash flow and profitability, while defaulting on the MCA result in added fees and damage to the business’s credit score.

Taking on an MCA impacts a business’s ability to secure future financing and are viewed as a sign of financial distress by lenders. Businesses must carefully review the terms of the agreement, calculate the total cost of the advance, and explore other business financing options before accepting an MCA offer to minimize the risks.

How to Choose The Right Merchant Cash Advance

Picking the right merchant cash advance (MCA) provider is necessary for businesses needing quick capital access. The right MCA provider leads to high costs, favorable repayment terms, and damage to the business’s credit score. Right MCA provider offers fair terms, reasonable fees, and a repayment plan that meets the business’s unique needs, considering various business financing options.

Business Loan and MCA: Choosing the Right Provider

The right MCA provider offers advice and support to help businesses grow and succeed. Choosing the wrong MCA provider impacts the business’s reputation and relationships with suppliers and customers. But choosing the right MCA provider offers businesses peace of mind and the ability to focus on their operations without worrying about cash flow. It’s essential to consider various lending options and business loan types to find the best match for your company.

Listed below are tips on how to choose the right lender.

- Shop around. Shop around and compare offers from multiple providers to find the best terms and rates. Don’t accept the first MCA offer that comes along. Consider funding MCAs from various sources before making a decision.

- Research the provider. Research the provider’s reputation and track record before accepting an MCA offer. Look for reviews and testimonials from other businesses that have worked with the provider, and check with the Better Business Bureau to see if there have been any complaints.

- Understand the costs and fees. Read the terms of the agreement carefully and understand all the associated costs and fees, including the factor rate, holdback percentage, and any extra fees. Calculate the total cost of the advance and compare it to other financing options to determine if it’s a good deal.

- Evaluate the repayment terms. Check the length of the repayment term and the holdback percentage to determine if it’s feasible for the business to repay the advance promptly.

- Assess the impact on cash flow. The holdback percentage means that a percentage of daily credit card sales are withheld to repay the advance. Check its impact on the business’s cash flow and ability to manage day-to-day expenses.

- Explore other financing options. Examine other financing options, such as traditional loans, lines of credit, or equipment financing, to determine if there are more affordable or better-suited options for the business’s needs. Investigate potential options that may provide better terms and conditions.

How To Use A Merchant Cash Advance Wisely

Merchant cash advances (MCAs) are a useful financing tool for businesses needing quick access to capital. But they have risks and high costs that business owners need to know. Businesses must use MCA for short-term needs, create a repayment plan, use the funds wisely, negotiate the terms, and monitor cash flow.

1. Use MCA For Short-term Needs

An MCA or Merchant Cash Advance is a financing solution that provides businesses with a lump sum of cash in exchange for a percentage of their future credit card sales. But it is necessary to note that MCAs are short-term financing solutions.

They are designed for businesses requiring quick capital access to meet short-term needs. MCAs have faster approval processes and fewer documentation requirements than traditional loans, making them a viable option for short-term needs.

An MCA is not recommended to cover long-term expenses or manage ongoing cash flow issues. Since MCAs involve a fixed fee that is applied to the advance amount, businesses end up paying a higher cost of capital over time.

The factor rate, holdback percentage, and fees add up quickly, making it a more expensive form of financing in the long run. Businesses must assess their financial situation and use forms of financing like MCAs judiciously for short-term needs only after weighing the costs and associated risks.

2. Have A Repayment Plan

Businesses must have a repayment plan in place before accepting an MCA. Creating a repayment plan involves assessing the business’s cash flow and projecting future sales. The plan must be realistic, factoring in the holdback percentage, repayment term, and any fees associated with the MCA.

Businesses must calculate the amount of money they need to set aside daily, weekly, or monthly to repay the MCA. They must factor in the holdback percentage, which means that a portion of their daily credit card sales is automatically deducted to repay the MCA.

Businesses must guarantee they have the financial resources to meet the daily deductions and maintain adequate cash flow for their operations. The repayment plan must consider any added fees charged by the MCA provider. Factoring in all the costs allows businesses to determine if they can afford to repay the MCA and avoid defaulting on the repayment plan. Additionally, businesses should be mindful of their business credit score and prioritize time payments to improve their borrowing potential in the future.

3. Use The Funds Wisely

Using funds from an MCA or Merchant Cash Advance wisely is needed to ensure that the business benefits from the cash infusion. Business owners must use the funds only for the intended purpose, which is to meet short-term business needs. Misusing the funds puts the business in a precarious financial situation and makes it difficult to repay the MCA.

Business owners must have a specific purpose, such as purchasing inventory, repairing equipment, or funding marketing initiatives. They must stick to the intended purpose and use the funds only for their reasons. Deviating from the intended purpose leads to overspending and needing more funds to meet the business’s immediate needs.

Using the MCA funds for non-business expenses is strongly discouraged. Avoid using the funds for personal expenses, such as vacations, luxury purchases, or even salary payments to business owners. Such expenses jeopardize the business’s financial stability and lead to difficulties in repaying the MCA.

Conclusion

Merchant Cash Advances (MCAs) are a popular alternative financing option offering small businesses fast capital access. They allow businesses to receive a lump sum of money in exchange for a percentage of their future sales, with repayment based on a percentage of daily credit card sales or bank deposits.

One significant advantage of MCAs is their flexible financing. MCAs provide quick access to cash but are more expensive than traditional financing options, making them more suitable for short-term needs. The eligibility requirements and fees vary widely between providers, making it essential for businesses to review the terms and fees before accepting an advance.

Thanks to the flexible financing nature, businesses can benefit from the flexibility, unrestricted use of funds, and fast access to capital that MCAs offer. This makes them an ideal financing option for businesses that need quick cash to take advantage of immediate opportunities.

Frequently Asked Questions

What is a Merchant Cash Advance, and how does it work?

A Merchant Cash Advance provides a lump sum of working capital to a business in exchange for a percentage of future credit card and debit card sales over a fixed time period. Repayment amounts fluctuate based on sales volume.

What are the typical terms and fees associated with Merchant Cash Advances?

Merchant Cash Advance fees are typically 1.10-1.50 times the advance, repayable in 4-12 months. Additional costs include origination fees of 1-10% and daily repayment amounts of 5-20% of credit card/debit sales.

How can businesses qualify for a Merchant Cash Advance?

Businesses can qualify for a Merchant Cash Advance by having at least 3 months of consistent credit/debit card sales history and meeting minimum monthly sales volumes that indicate sufficient revenue to repay the advance.

What are the advantages and disadvantages of using a Merchant Cash Advance for financing?

Advantages include quick and easy approvals, use of future sales versus credit scores, and daily fluctuations in payments. Disadvantages include high costs and potentially giving up more sales revenue than expected.