Loans are seen as a lifeline in times of financial distress, and not all loans offer the same advantages or disadvantages. The search for the most suitable loan option is daunting and overwhelming, especially if one needs a better credit score. To navigate the tricky terrain confidently, one must understand which loans are best for people with bad credit scores, like stepping stones on the river of life.

Unsecured personal loans and secured car title loans offer unique benefits depending on individual needs and circumstances. One can regain control over their finances and feel more secure about their prospects with careful understanding and research into different types of loan products available. For those looking for financial assistance, even with a bad credit score, there are bad credit loan options designed specifically to cater to these needs. With loans for borrowers with bad credit, it’s important to explore various personal loan lenders offerings to find the best terms and rates that fit your unique financial situation.

A loan that is best for bad credit loan companies is a secured loan that requires collateral, such as a car or home, to back up the loan. Another option is a payday loan, a short-term loan designed for people who need cash quickly. Payday lenders often provide these types of loans. Still, it’s recommended to explore other loan types before considering a payday loan. Cash advance loans are also an option, but they come with high-interest rates and fees, so like payday loans, they must only be used as a last resort.

SUMMARY

- Loans are a lifeline for people facing financial difficulties; not all loans offer the same advantages or disadvantages. Bad credit loan solutions can help those with poor credit history.

- Bad credit is a score below 600 on the FICO scale, and lenders are less likely to approve loans to borrowers with bad credit due to their perceived greater risk of defaulting on payments. Minimum credit score requirements can vary between different types of bad credit loans.

- Different types of bad credit loans are available to people with a poor credit history, including personal, payday, secured, title, and co-signer loans. Credit Score and Eligibility Requirements should be carefully evaluated before deciding.

- It is necessary to carefully understand any loan’s terms and interest rates before taking it out and understanding the potential consequences of defaulting. Some loans may offer competitive interest rates, even for borrowers with bad credit.

- The benefits of obtaining a bad credit loan include access to funds, an opportunity to improve your credit score, flexibility in repayment options, and higher chances of approval.

- Researching the best option for a bad credit loan requires time and effort. Still, it is worth it if done correctly to avoid high-interest loans or scams and to achieve financial goals.

What Is Bad Credit?

Bad credit is a consumer’s score below 600 on the FICO (Fair Isaac Corporation) scale. A consumer with low scores is deemed to have poor creditworthiness compared to higher scores. The lower rating indicates that lenders are less likely to approve loans for people with bad credit due to their perceived greater risk of defaulting on monthly payments.

Loan options are still available for people with poor or no credit history, and they come at a cost regarding higher interest rates or fees. People looking for bad credit loans must research all the options before committing, which includes researching different lenders, such as credit unions and online lenders, reading reviews from other customers, and comparing loan features such as repayment periods and interest rates. Speaking with a financial advisor helps borrowers make informed decisions based on their circumstances.

What Are the Different Types of Loans Available to Bad Credit People?

Individuals with bad credit can obtain several types of loans. Some of these include debt consolidation loans, which help to combine multiple high-interest debts into a single lower-interest loan, making it easier to manage payments. Another option is installment loans, which provide fixed repayment terms and more predictable monthly payments. These options, along with the help of financial advisors or institutions like credit unions and online lenders, can provide feasible financial solutions for individuals with bad credit.

Different types of bad credit loans are available to people with a poor credit history. Knowing the different kinds of loans available to bad credit borrowers is necessary because it helps them find the best loan option that suits their financial situation. Researching and comparing the various options is necessary to find a loan that best fits your needs and budget.

Different loans have varying terms and requirements, so understanding the options available helps borrowers make informed decisions and avoid high-interest loans or scams. Borrowers potentially save money on interest and fees by researching and comparing different loan options, improve their credit scores by making timely payments, and achieve their financial goals.

Listed below are the different types of loans available to bad credit people.

- Personal loans

Personal loans are unsecured loans that are used for a variety of purposes. Although the interest rates are higher, they are available to people with bad credit personal. Credit range may affect interest rates, and late payments can impact approval. Good credit personnel is important to improve the loan application process. - Payday loans

Payday loans are short-term loans that are due on your next payday. They are designed for people who need quick cash and have a low credit score. They have very high-interest rates and fees. - Secured loans

Secured loans require collateral such as a car or home to secure the loan. Lenders work with people who have bad credit because there is collateral involved. - Title loans

Title loans are secured loans that use your car title as collateral. Title loans have high-interest rates and fees like payday loans. - Co-signer loans

The co-signer is responsible for the loan if you cannot make late payments. This type of loan can facilitate the loan application process, especially for those with bad credit personal.

It’s necessary to carefully understand any loan’s terms and interest rates before taking it out. You must afford the payments and understand the potential consequences of defaulting on the loan, which can negatively impact your credit rating.

Individuals can explore alternatives within the $4,000 to $6,500 range. For $4,000 or $4,500, installment or personal loans from online lenders or credit unions can be considered. A $5,500 loan opens options like debt consolidation or secured loans, providing flexibility for specific financial goals. Moving to $6,000, in-depth exploration of debt consolidation options becomes feasible.

Finally, a $6,500 loan, through personal, installment, or credit union loans, can address various financial needs. Thoroughly understanding terms and making informed decisions remains crucial to avoid negative credit impacts. Exploring alternatives within these specific amounts allows borrowers to tailor choices to their unique circumstances and needs.

What Is the Perfect Credit to Get a Loan?

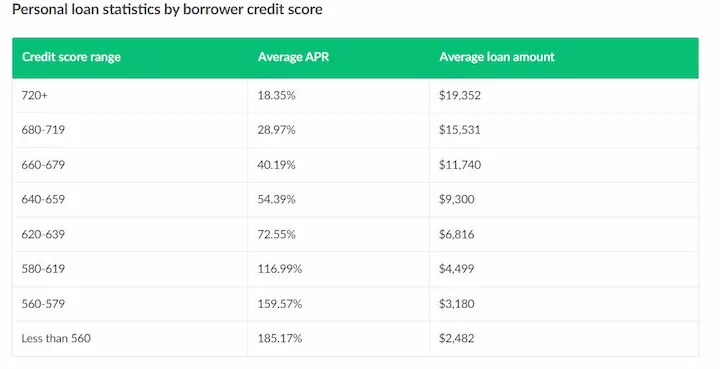

Borrowers need a credit score of at least 610 to 640 to qualify for a personal loan. To qualify for a lender’s lowest interest rate, borrowers need a score of at least 690, according to Bankrate. Lenders accept anything above a 670 FICO credit score to be “good” credit. However, “very good” credit scores are above 740, and “excellent” are above 800. Your credit rating plays a significant role – you’re likely to be approved for a loan with a good credit score, and the higher your score, the lower your rates.

Credit Score Ranges and Personal Loan Qualification Information, including credit rating impact on interest rates.

| Credit Score Range | Loan Qualification | Interest Rate Range |

|---|---|---|

| 300 – 579 | Poor | Not qualify for a loan or only qualify for high-interest loan applications. |

| 580 – 609 | Fair | Qualify for a loan but with higher personal loan rates. |

| 610 – 639 | Good | Likely to qualify for a loan but with higher interest rates during the approval process. |

| 640 – 669 | Good | Likely to qualify for a loan but with higher interest rates due to credit decisions. |

| 670 – 739 | Very Good | Likely to qualify for a loan with lower personal loan rates. |

| 740 – 799 | Excellent | Likely to qualify for a loan with the lowest interest rates and better credit decisions. |

| 800 and above | Exceptional | Likely to qualify for a loan with the lowest interest rates and the best terms, considering the approval process. |

Lenders’ qualification requirements and interest rate ranges vary depending on the lender. A good or high credit score does not guarantee loan approval as lenders look at factors such as annual income and debt-to-income ratio.

What Are the Factors to Take Into Account for Applying for a Bad Credit Loan?

Knowing all the options available when looking for a bad credit loan is necessary. Weighing out the pros and cons is like navigating a minefield. Factors such as eligibility requirements, interest rates, origination fees, repayment terms, and prepayment penalties associated with loans must be taken seriously. An individual must make the best choice for their financial future.

Comparing different lenders and products on offer help shed light on which ones suit people with poor credit histories. Understanding any potential implications when taking a loan is key to ensuring that one ends up with only what is necessary and prepared for financial emergencies

Being aware of common traps such as hidden costs or deferred payments saves individuals from getting stuck in a vicious cycle of debt. Researching the best option for a bad credit loan requires time and effort but is worth it if done correctly. Understanding what you’re signing up for is necessary before committing to anything.

What are the Benefits Of Taking A Bad Credit Loan?

The benefit of obtaining a bad credit loan is that it provides fast access to funds for people who otherwise need help to secure traditional financing. The online application process for applying and receiving approval takes significantly less time than conventional methods making them ideal in situations where quick access to cash is required. Additionally, same-day funding can be a lifesaver for borrowers with credit scores that typically prevent them from receiving loans. In most cases, the loan proceeds are available within one business day, providing much-needed financial relief for those in need.

Another advantage associated with taking a bad credit loan is that they help individuals improve their overall financial standing over time by providing the opportunity to make payments on time against the debt owed, which demonstrates responsibility on behalf of the borrower leading to improved future borrowing options from lenders due to being seen as a reliable customer. Bad credit loans offer support during times of hardship while helping borrowers with limited credit history rebuild their creditworthiness and create better opportunities in the future on reasonable terms.

Listed below are the benefits of taking a bad credit loan:

- Payments on time: Making timely payments against your loan helps improve your credit score and demonstrates your responsibility to lenders, opening up more borrowing options in the future.

- Limited credit history: For those with limited credit history, bad credit loans can provide a means to establish a positive track record of responsible borrowing, ultimately leading to improved creditworthiness.

- Reasonable terms: While the interest rates for bad credit loans may be higher, they still allow borrowers to rebuild their credit through reasonable terms and manageable payment schedules.

- Access to funds

A bad credit loan gives you access to funds you cannot obtain. Access to funds is particularly useful if you have an urgent expense that needs to be paid, such as medical bills, car repairs, or an emergency expense. - Opportunity to improve your credit score

You can improve your credit score by taking a bad credit loan and repaying it on time which helps you qualify for better loan terms in the future, such as lower interest rates, higher loan amounts, or online loans. - Flexibility

Many bad credit loans offer flexibility in repayment options, such as flexible repayment terms or the ability to make smaller payments making it easier for you to manage your finances and repay the loan on time. - Higher chances of approval

The approval criteria are less strict than traditional loans since bad credit loans are designed for people with poor credit scores, which means you have a higher chance of being approved for a bad credit loan than other types of loans, which makes it highly attractive for potential borrowers who need to provide a proof of income to increase their chances of approval.

How To Qualify For A Bad Credit Loan?

Understanding the various criteria lenders use to determine eligibility to qualify for a bad credit loan is necessary. Having poor or no credit history is an obstacle, but there are still options available with certain qualifications. From seeking out alternative lenders to building up one’s credit score, here are three key steps when applying for a bad credit loan.

- Obtain a copy of your credit score. Obtaining a copy of one’s credit report is necessary, allowing borrowers to gain insight into their current financial situation and assess what changes need to be made moving forward. It gives accuracy as far as any reported information goes. Moreover, check your credit report from major credit bureaus to better understand your financial standing. Potential applicants must begin looking into different types of lenders specializing in bad credit loans, such as online platforms or peer-to-peer networks offering more favorable terms than traditional financial institutions.

- Establish a budget. Establishing a budget over time helps demonstrate responsibility and good money management skills, which are beneficial when evaluating applications from low-scoring individuals. Taking smaller steps like paying bills on time regularly, keeping balances low on existing accounts, and managing auto loans effectively go a long way towards increasing the chances of approval for a loan, even with subpar ratings. Being proactive by contacting lenders helps streamline the process; many institutions have programs for people dealing with adverse circumstances.

- Prepare all the requirements. People with less-than-perfect credit histories find themselves better prepared while navigating the complicated waters of securing financing despite their past missteps. Ensuring you have your bank statements and other necessary financial documents ready can make the process smoother for both the borrower and the lender. Understanding the requirements beforehand gives borrowers the knowledge to make informed decisions about their future borrowing needs. It increases their likelihood of finding suitable lending solutions that fit their parameters. Remember that each credit inquiry impacts your overall credit score, so plan and have all your documents well-organized.

How To Choose The Best Bad Credit Lender?

Choosing the best bad credit lender is a challenging task. It is necessary to compare lenders to secure the most favorable terms and conditions when taking loans for people with less-than-stellar credit. Choosing the best bad credit lender is necessary because it significantly impacts your financial health.

Traditional lenders only lend you money when you have good credit, and you are forced to turn to alternative lenders. Not all alternative lenders are created equal. Other lenders charge exorbitant interest rates and hidden fees or use predatory lending practices. Choosing the best bad credit lender helps you avoid falling into a cycle of debt and financial instability.

A reputable lender offers transparent terms and reasonable interest rates and works with you to create a repayment plan that fits your budget. You rebuild your credit and improve your financial health by selecting a trustworthy lender.

Here are four key elements when evaluating potential direct lenders:

- Choice for borrowers: When looking for a lender, it is important to explore various options to ensure you have the best selection available. An online lending platform can provide a wide range of choices for borrowers to help you make an informed decision.

- Cost of borrowing: Knowing the various fees, interest rates, and overall costs is crucial for each loan. Evaluating the cost of borrowing options will help you determine which lender is right for you.

- Competitive Rates: Seeking out the most advantageous loan terms is essential in making a sound financial decision. Examine and compare the rates various lenders offer, and look for those with the best competitive rates.

- Reputation and Customer Service: Ensuring the lender has a positive reputation and strong customer service can significantly impact your overall experience. Researching testimonials and reviews from previous borrowers is an excellent way to evaluate potential lenders.

- Reputation

It is necessary to research each lender thoroughly before making a decision. Read customer reviews and ratings on independent review sites and check out their online presence via social media or other search engine websites. Consider their payment history to understand their credibility better. - Rates & Fees

When selecting the right bad credit lender, reviewing loan fees, interest rates, repayment terms, and penalties is necessary. Compare different lenders’ offerings side-by-side to know you are getting the best deal. Look for those offering flexible repayment options to help you deal with unexpected expenses or major expenses. - Loan Amounts & Terms

Determine how much money you need and see which lenders offer funds within your budget range. Take note of minimum loan amounts provided by the lenders and evaluate if the payment schedule fits into your current spending plan so that repaying the loan won’t cause undue financial stress. - Customer Service

The quality of customer service offered by any lender makes an enormous difference in how smoothly the process goes from start to finish. Customers must have access to friendly representatives who answer questions competently and efficiently. A lender with reliable customer service is crucial for addressing concerns about flexible repayment options and managing unexpected expenses.

Individuals are better equipped to select the ideal bad credit lender for their unique situation. Considering factors such as monthly income, lenders often offer loans to people based on their financial history and ability to repay. Taking a few moments up front to do the research pay off significantly through lower costs, more flexible payment plans, and even improved vendor relationships due to timely time payments and positive interactions with customer service personnel.

At RixLoans, we understand the importance of providing financial solutions to individuals with varying credit histories. To better serve our customers, we are active in several states across the United States. Below, you’ll find a list of the American states where our services are readily available, ensuring that those with bad credit have access to the loan options that suit their needs.

| AL – Alabama | AK – Alaska | AZ – Arizona | AR – Arkansas |

| CA – California | CO – Colorado | CT – Connecticut | DE – Delaware |

| DC – District Of Columbia | FL – Florida | GA – Georgia | HI – Hawaii |

| ID – Idaho | IL – Illinois | IN – Indiana | IA – Iowa |

| KS – Kansas | KY – Kentucky | LA – Louisiana | ME – Maine |

| MD – Maryland | MA – Massachusetts | MI – Michigan | MN – Minnesota |

| MS – Mississippi | MO – Missouri | MT – Montana | NE – Nebraska |

| NV – Nevada | NH – New Hampshire | NJ – New Jersey | NM – New Mexico |

| NY – New York | NC – North Carolina | ND – North Dakota | OH – Ohio |

| OK – Oklahoma | OR – Oregon | PA – Pennsylvania | RI – Rhode Island |

| SC – South Carolina | SD – South Dakota | TN – Tennessee | TX – Texas |

| UT – Utah | VT – Vermont | VA – Virginia | WA – Washington |

| WV – West Virginia | WI – Wisconsin | WY – Wyoming |

What To Do If You Are Unable to Afford Your Bad Credit Loan Payments?

You must immediately avoid defaulting on your loan if you cannot afford bad credit loan payments, such as personal installment loans. The first step is to contact your lender and explain your situation. Ask if any options are available, such as a payment plan or a temporary forbearance.

Reviewing your budget to see if there are any areas where you can cut back on expenses frees up the extra money you can put toward your loan payments. Look for ways to reduce your monthly bills, such as canceling subscriptions or negotiating with service providers for the lowest rate. A credit counselor can help you create a budget based on your regular income and develop a plan to manage your debt. They can negotiate with your lenders on your behalf to help you get more favorable repayment terms, such as lower late payment fees and manageable monthly installments.

Defaulting on a loan can have serious consequences, including damage to your credit score and legal action by your lender. You can minimize the impact of a bad credit loan on your overall financial health by taking proactive steps to address your financial difficulties, such as considering a wide range of options and consulting financial experts.

What To Do To Avoid Bad Credit Loan Scams?

Bad credit loan scams are becoming increasingly common, and taking measures to protect yourself is necessary. First, you must research any individual lender and look for reviews and feedback from other borrowers to gauge their legitimacy. Be wary of lenders that offer guaranteed approval or ask for upfront fees. Legitimate lenders review your credit history and financial situation before offering a loan, and they won’t require payment before processing your formal application.

Various loan sizes and alternative loans can be excellent choice when looking for a bad credit loan. These options help you find a loan that suits your needs and budget without falling prey to scams or predatory lending practices. Always thoroughly research and compare different loan offers before making a decision.

You must be careful about sharing your personal and financial information online. Scammers use the information to steal your identity or commit other fraudulent activities. Know that the website is secure and that you’re on a legitimate lender’s website before submitting sensitive information online. Check for a padlock icon in your browser’s address bar, or look for “https” in the URL. Read the terms and conditions carefully before signing any loan agreement. Understand the interest rate, fees, repayment terms, and other relevant details.

Conclusion

Quick funding is often a choice for people with bad credit, as they have various loan options, including unsecured personal loans, secured loans, payday loans, title loans, and co-signer loans. Some common types of loans, such as payday loans, might come with a variable interest rate. Careful research and comparing different lenders and loan products are necessary to avoid high-interest loans or scams before committing to any loan. In case of an emergency cost, considering the factors of a bad credit loan, including interest rates, repayment terms, and fees, is crucial to make a well-informed decision.

The benefits of a bad credit loan include access to funds, an opportunity to improve your credit score, flexibility in option for people with poor credit, and higher chances of approval. Taking a bad credit loan helps individuals improve their financial standing over time, rebuild their creditworthiness, and create better opportunities for the future.

Some key features of bad credit loans are quick funding times, usually available the day after approval. These loans may have a maximum rate that can be high but provide the borrower with the funds they need. They also come with various Term lengths to provide flexibility in repayment schedules.

Frequently Asked Questions

How can I get a loan with bad credit?

Options to get a loan with bad credit include secured loans with collateral, credit-builder loans, FHA loans, and personal loans from specialized lenders that offer higher rates.

What are the options for bad credit personal loans?

Bad credit personal loan options include online marketplace lenders, peer-to-peer lending, credit union loans, payday alternative loans, and loans from banks or credit unions with guaranteed approval.

Are there any specific loans for people with low credit scores?

Specific loans for people with low credit include FHA loans, VA loans, USDA loans, secured loans, and loans from lenders specializing in applicants with less-than-perfect credit.

What is the difference between secured and unsecured loans for bad credit?

Secured loans require collateral while unsecured loans do not. Secured loans typically have lower interest rates but risk losing the assets if payments are missed.

How can I improve my chances of getting approved for a loan with bad credit?

Ways to improve approval odds for loans with bad credit include having a co-signer, providing collateral, demonstrating steady income, limiting loan amount requests, and improving your credit first.