Financial stability is necessary today, and payday loans are a popular option for people who need quick cash. Taking a payday loan has long-term consequences on your credit score. The article explores the impact of payday loans on your credit history and answers how long payday loans stay on your credit.

Payday loans are the perfect solution for many individuals seeking financial assistance. Payday short-term loans provide borrowers immediate access to money they cannot obtain. Payday loans have high-interest rates and fees that trap borrowers in cycles of debt. It’s necessary to assess how payday loans impact your credit standing over time to fully understand the implications of borrowing through a payday lender.

SUMMARY

- Payday loans are short-term, high-interest loans that cover unexpected expenses or emergencies. Still, they are risky due to their high-interest rates and fees.

- Defaulting on payday loans negatively affects credit scores and stays on credit reports for up to seven years.

- Late payments hurt credit scores significantly, and credit counseling services assist in managing debt and avoiding predatory lending practices.

- Payday loans do not require a credit check, making them an option for people with bad credit, and lenders get most of their revenue from repeat borrowers.

- Loans cost 400% annual interest (APR) or more, and the finance charge ranges from $15 to $30 to borrow $100.

- Minimizing the negative effects of payday loans on credit involves improving credit scores through repayment of existing debt, careful budgeting, monitoring credit reports, and avoiding default on payday loans.

What Is A Payday Loan?

Payday loans are short-term, high-interest loans that people use to cover unexpected expenses or emergencies. Payday loans are risky for borrowers due to their extremely high interest rates and fees despite their convenience and accessibility. Most experts argue that payday loans must only be used as a last resort when other options, such as debt consolidation or credit counseling, have been exhausted.

Potential borrowers must understand the loan eligibility criteria and the true cost of borrowing before taking a payday loan. Improving one’s financial literacy help prevent individuals from falling into the cycle of debt associated with payday loans.

How Do Payday Loans Affect My Credit Score?

Payday loans significantly impact your credit score, particularly if you need more time to repay them. Late repayments and defaulting on payday loans negatively affect your credit score and stay on your credit report for up to seven years. It is necessary to avoid penalties by paying back the loan on time or seeking an extension from the lender.

Borrowing limits must be evaluated since taking large amounts of money puts you in financial distress and may lead to late repayment later on. Credit counseling services assist with managing debt and avoiding predatory lending practices. It is necessary to evaluate all options before making a decision that harms your creditworthiness.

How Long Do Payday Loans Stay On My Credit Report?

It is reported to the Credit Reporting Agencies. An unpaid payday loan stays on your credit report for up to six years, which has negative effects on your credit score according to _MyMarbl_e. It’s necessary to try to avoid a payday loan.

There are options available, such as debt consolidation and budgeting tips, to help you manage your finances effectively if you struggle with multiple payday loan debts. Late payments hurt your credit score significantly, and seeking professional assistance through credit counseling is beneficial in improving your financial situation.

| Scenario/ Data | Explanation |

| Definition of Payday Loans | A short-term unsecured loan with high-interest rates is easy to obtain. |

| Credit Check Requirement | Payday loans do not require a credit check, making them an option for people with bad credit loans. |

| High-Interest Rates | Payday loans incur high fees, with the cost being equivalent to an interest rate of 500-600%. Cash advance loans can also have high fees and interest rates. |

| Repeat Borrowers | Payday lenders get 91% of their revenue from borrowers who take five or more loans. |

| Difficulty to Pay Back | 4 out of 5 payday loan borrowers default or renew the loan one or more times. |

| Impact on Credit Score | Taking a payday loan does not directly affect your credit score. However, bad credit loans can potentially impact if not managed properly. |

| Loan Repayment | Late payments or unpaid loans stay on your credit file for six years. This applies to both payday loans and cash advance loans. |

| Bounced Checks | Your bank closes your account and sends it to a collection agency if you cannot pay a bounced check. |

The table highlights the key scenarios and data points regarding payday loans and their effect on credit ratings. It includes an explanation of payday loans, the lack of credit check requirements, the high-interest rates, and how the business model of payday loans relies on repeat borrowers.

The table highlights the difficulty of paying back payday loans and how late payments or unpaid loans affect one’s credit rating. The table highlights the risk of bounced checks and how they lead to account closure and being sent to a collection agency.

How Much Interest Is the Payday Loan Borrower Charged?

Payday loans range from $100 to $1,000, depending on state legal maximums. The average loan term is about two weeks. Loans cost 400% annual interest (APR) or more. The finance charge ranges from $15 to $30 to borrow $100, according to PaydayLoanInfo.

The finance charges for two-week loans result in interest rates from 390 to 780% APR. Shorter-term loans have even higher APRs. Rates are higher in states that do not cap the maximum cost. These loans are a financial product that may lead to debt traps for borrowers.

| Loan Size | Average Loan Term | Maximum Legal Loan Size | Finance Charge (per $100) | APR (based on finance charge) | Scenario |

| $100 | 2 weeks | $500 (in some states) | $15 | 390% | State with capped maximum cost |

| $250 | 4 weeks | $1000 | $30 | 360% | State with capped maximum cost |

| $500 | 2 weeks | $1000 | $30 | 780% | State without capped maximum cost |

| $1000 | 3 weeks | $1000 | $25 | 393% | State without capped maximum cost |

How to Minimizing The Negative Effects Of Payday Loans On Your Credit?

Payday loans harm a person’s credit score, but there are strategies to minimize the effect. Improving a credit score through repayment of existing debt, careful budgeting, and monitoring credit reports helps reduce the negative effects of payday loans. It is necessary to avoid default on payday loans as it results in a sharp drop in credit scores.

Paying payday loans on time helps maintain a good credit score as it shows lenders that the borrower is reliable and trustworthy. People can consolidate payday loans or refinance them as it reduces the overall amount owed and the amount of interest paid. Ensuring that payments are made on time and in full each month helps to prevent damage to the credit score.

- Improve your Credit Score. Improving your credit score is necessary to mitigate the negative effects of payday loans on your credit. Individuals can take control of their finances and minimize the long-term negative impact of payday loans on their credit by implementing the strategies consistently. Debt management and credit counseling improve your financial situation and credit score. Credit repair services are helpful for people struggling to improve their credit scores. Still, they have high fees and need to provide guaranteed results. A more cost-effective approach is loan repayment, where you prioritize paying off any outstanding debts before taking on new ones. Budget planning is another significant strategy for improving your credit score after taking a payday loan which involves creating a realistic plan that allows you to pay off any debts while still meeting your daily expenses.

- Avoid default. Defaulting leads to significant financial consequences, including damaged credit and penalties. There are several tips that borrowers must know to prevent default. One effective strategy is prioritizing loan repayment by creating a realistic budget plan allowing timely payments of outstanding debts. Borrowers must seek alternative repayment options their lenders offer, such as installment plans or refinancing. Another key factor in avoiding default is maintaining open communication with lenders. They must immediately contact their lender to explore available options before missing a payment deadline if a borrower anticipates difficulty making payments. Seeking financial counseling from a reputable source helps individuals develop strategies for managing existing debt and preventing future financial hardship. By incorporating the techniques into their financial management plan, borrowers can minimize the negative effects of payday loans on their credit while working towards long-term financial stability.

- Pay Loans On Time. Avoiding penalties and building credit are essential factors in successfully managing payday loans. Late or missed payments lead to penalties, damage to credit scores, and even default. Paying payday loans on time helps minimize negative effects on credit scores while working towards long-term financial stability. Borrowers must budget wisely and prioritize loan repayment as part of their overall financial plan. Creating a realistic budget that allows for timely loan payments must be a top priority for borrowers. Seeking assistance from lenders through alternative repayment options such as installment plans or refinancing helps you prompt payment while managing existing debt effectively. Seeking financial counseling from reputable sources provides strategies for avoiding future financial hardship by teaching individuals how to manage their finances more responsibly.

What Is The Process For Applying For A Payday Loan?

Payday loans have been around for centuries, and applying online has become increasingly popular in recent years. Knowing the online application process for a payday loan is vital because it helps you decide if the loan provider is right for you. Understanding the steps involved in getting approved for a cash advance payday loan is necessary.

Knowing the process helps you prepare the documents and information required for the application, saving you time and frustration. Being informed about the process for applying for a payday loan online helps you make a responsible and informed decision about your financial needs.

Below is the process for applying for a cash advance payday loan from a loan provider.

- Research online payday lenders. Research to find a payday loan lender that suits your needs. Know the factors such as interest rates, fees, repayment terms, and customer reviews. Consider the initial loan amount and type of loan offered by various lenders.

- Gather the required documents. You must provide proof of income, a state-issued ID or driver’s license, and proof of an active bank account. Make sure that the documents are up-to-date and reflect your current financial situation.

- Fill out an application. Gather your documents and complete the online payday loan application. You’ll be asked to provide personal information such as your name, address, phone number, and email address. During this process, you might be asked about your desired initial loan amount and the type of loan you’re looking for.

- Provide documentation. The lender contacts you to request documents such as proof of income or residency. Ensure that the documents provided correspond to the type of loan you’re applying for.

- Wait for approval. The lender determines if you meet their lending criteria and approve or deny your loan request after reviewing your application and documentation. This process includes verifying that the initial loan amount suits your financial situation.

- Sign the loan agreement. Carefully read through the terms of the agreement before signing it. You must understand all fees and repayment terms associated with the loan and any specific terms related to your requested type of loan and initial loan amount.

What Should I Consider Before Applying For A Payday Loan?

It is necessary to understand that payday loans have high-interest rates and fees. Payday loans are more expensive than traditional bank loans or other forms of financing because many lenders need to run credit checks when processing payday loan applications.

It is necessary to note that certain states limit the number of times a borrower can take a payday loan each year, so it is only feasible to rely on them as a source of short-term funding in certain cases. There are costs associated with the loan which make repayment difficult or if payments are missed or late fees accrued.

Below are the things to look at before applying for a payday loan.

- Potential for Debt CyclePayday loans are a quick solution to a financial problem, but they lead to a debt cycle if you cannot repay the loan on time. Be sure you plan to repay the loan in full and avoid getting trapped in a cycle of debt before taking a payday loan.

- Alternative OptionsLook for alternative options such as borrowing from a friend or family member, negotiating with creditors or applying for a personal loan from a bank or credit union.

- Your Credit ScorePayday loans do not require a credit check, but they still affect your credit score if you cannot repay the loan on time. Determine if a payday loan is worth the potential impact on your credit score.

How to Repay A Payday Loan?

Repaying a payday loan requires borrowers to make regular monthly payments or time payments until the balance has been paid in full. Payday loan payments are due within two weeks or so after the initial expense was taken care of with the loan amount. Making all payments on time is necessary to avoid late fees and other penalties if payment deadlines still need to be met.

Failing to repay a payday loan has serious consequences, such as damage to credit scores. Taking control of finances and creating backup plans for unexpected expenses help identify that borrowers are not overburdened by debt or unable to meet their obligations with timely time payments when it comes time for repayment.

Below are the steps to repay a payday loan with manageable monthly payment options.

- Make a Payment Plan. The first step in repaying a payday loan is to make a payment plan that works for your budget. Looking at your income, expenses, and outstanding debt is necessary to create a realistic repayment plan without financial stress.

- Prioritize the Payday Loan. It’s necessary to prioritize payday loan repayment over other debts to prevent extra fees or interest charges from accruing when paying off multiple debts.

- Pay More Than the Minimum Payment. Increase the amount paid towards the payday loan each month, which helps pay off the loan faster but reduces the interest charged overall.

- Contact Your Lender. Contact your lender and explain your situation if you struggle to repay the payday loan on time. Many lenders offer extended payment plans or negotiate alternative options that work better for your circumstances.

Can Payday Loans Help Me Improve My Credit?

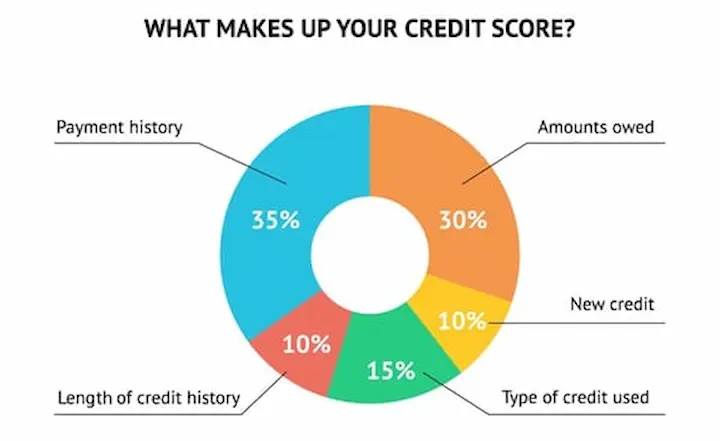

Developing good saving habits and making timely payments on existing debts are much better ways to improve your credit in the long run. Debt consolidation loan or seeking credit counseling is helpful for individuals struggling with high debt levels. Maintaining a good Payment history is crucial for a strong credit score.

Financial planning is key to maintaining a healthy credit score over time. Payday loans must only be used as a last resort and utilized cautiously to avoid damage to one’s financial standing, while payday loans seem like a quick fix.

Final Thoughts

Payday loans are short-term, high-interest loans that people use to cover unexpected expenses or emergencies. Payday loans have high fees and interest rates, making them risky. Taking a payday loan has long-term consequences on your credit score, as late payments or unpaid loans stay on your credit file for up to six years.

Improving financial literacy and exploring other options, such as debt consolidation or credit counseling, is necessary before taking a payday loan. It is necessary to pay back loans on time, consolidate or refinance them, and improve credit scores through careful budgeting and monitoring credit reports to minimize the negative effects of payday loans on your credit score.

Frequently Asked Questions

What is the impact of a payday loan on your credit score?

Payday loans can negatively impact your credit score if you are unable to repay the loan on time, resulting in collections activity that hurts your credit history and score.

How can I remove a payday loan from my credit report?

To remove a payday loan from your credit report, you can negotiate directly with the lender, dispute information with the credit bureaus, or utilize credit repair agencies to dispute on your behalf.

Do payday loans show up on my credit report immediately?

Most payday lenders do not report to credit bureaus immediately, but the loan will likely show up on your next credit report if it remains unpaid for 60+ days and is sent to collections.

Will a payday loan affect my ability to get other types of loans?

Yes, an unpaid payday loan sent to collections can negatively impact your credit score, which could affect approval odds and interest rates for other loans and credit products.

How long does it take for a payday loan to disappear from my credit report?

A paid payday loan will disappear from your credit report within 7 years, but an unpaid/collections payday loan can potentially stay on your credit report for up to 7 years from the original default date.