The number of American population who borrow money from a payday lender has increased by more than 50 percent since 2010, according to new payday loan statistics released today by the Consumer Financial Protection Bureau (CFPB). The CFPB’s analysis found that nearly 2 million American borrowers borrowed $3 billion in 2014 alone, up from 1.4 million in 2010. This represents an increase of roughly 55 percent over four years.

In addition, the average payday loan taken by borrowers during this period was about $500, up from $350 in 2010.

These findings come as part of the CFPB’S first-ever payday loan user statistics report on consumer borrowing trends. The bureau analyzed data collected through its annual consumer survey, conducted between October 2013 and September 2014.

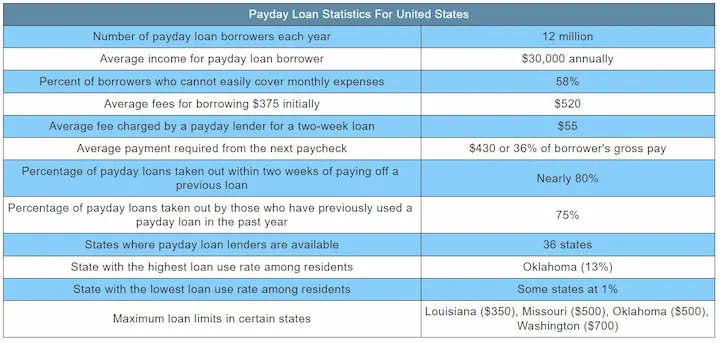

The CFPB’s findings show that while the overall number of payday loan borrowers has grown substantially, the percentage of borrowers using these short-term, high-cost loans has remained relatively stable. In 2014, about one in five U.S. households used a payday loan, compared with one in six in 2010. This highlights the expansion of the payday lending industry and its impact on the American population. Despite increasing payday loan fees and the high annual interest rates associated with these loans, the payday loan market continues to grow.

What Exactly Are Rixloans Payday Loans?

Payday loans from RixLoans are small short-term cash advances typically made for less than two weeks. These loans help Payday borrowers cover unexpected emergencies or address other financial emergencies until they receive their next paycheck.

While most states regulate payday lending, some allow payday loan lenders to charge significantly high payday loan rates and fees. As a result, borrowers often pay much higher costs than those charged by traditional banks and credit unions. Online lenders and payday loan stores may offer more convenience but are often associated with higher rates and fees.

Some experts say that payday loans may be desirable to low-income individuals because they offer quick access to funds without collateral. However, others argue that the loans trap borrowers into a cycle of debt and force them to rely on these expensive products, like high-interest payday loans.

Who Uses RixLoans Payday Loans?

Many people turn to RixLoans payday loans to cover their monthly expenses when short on cash. This is especially true for people facing unexpected emergencies or other financial needs that arise before their next paycheck. Payday loan providers like RixLoans may often be one of the few options for those with a poor credit history or limited credit record.

It’s important to note that payday loans should be used sparingly and only for short-term purposes. Additionally, borrowers should consider Alternatives to payday loans to avoid being stuck in a cycle of debt. Shop around and compare payday loan rates and loan terms before committing to any payday loan lender.

Payday loans from RixLoans are popular among lower-income workers, including recent college graduates, single parents, and military personnel. But most borrowers are employed full-time, and most work in service jobs such as retail, food preparation, and healthcare. The majority of payday loan users are caught in this cycle, and payday loan usage is quite high among these groups.

According to the CFPB’s analysis, women were slightly more likely than men to take out payday loans in 2014. About 15 percent of female borrowers used a payday loan versus 13 percent of male borrowers. However, regarding race, ethnicity, and income, there were no significant differences in how many people used payday loans. With a single payday loan more accessible now than ever, the Payday lending statistics show the need and demand for these services.

Payday loans have become a common financial tool for many Americans facing unexpected expenses. At RixLoans, we understand the importance of providing access to these services when they are needed most. Below, you will find a comprehensive list of the American states where our company is actively offering payday loan solutions. This data sheds light on the widespread demand for such financial assistance across the nation. Refer to the table for a detailed overview of our active regions.

| Alabama | Alaska | Arizona |

| Arkansas | California | Colorado |

| Connecticut | Delaware | District Of Columbia |

| Florida | Georgia | Hawaii |

| Idaho | Illinois | Indiana |

| Iowa | Kansas | Kentucky |

| Louisiana | Maine | Maryland |

| Massachusetts | Michigan | Minnesota |

| Mississippi | Missouri | Montana |

| Nebraska | Nevada | New Hampshire |

| New Jersey | New Mexico | New York |

| North Carolina | North Dakota | Ohio |

| Oklahoma | Oregon | Pennsylvania |

| Rhode Island | South Carolina | South Dakota |

| Tennessee | Texas | Utah |

| Vermont | Virginia | Washington |

| West Virginia | Wisconsin | Wyoming |

What Do People Use RixLoans Payday Loans For?

According to the CFPB, the top three reasons why consumers borrow from a payday lender include:

- Access to money: Many borrowers turn to payday loans for quick, easy access to cash. Payday loans can be attractive for those who may not qualify for a traditional loan due to a lack of credit history or proof of income.

- Majority of borrowers: The typical borrowers of payday loans include those who need short-term financial assistance to cover bills or unexpected expenses between paychecks.

- Percentage of payday loan: As per payday loans statistics, a large portion of payday loans are secured by consumers who regularly use these services, often to replace previous loans or to supplement their income.

It is essential to address the issue of regulation of payday loans to protect the interests of borrowers, ensure fair loan interest rates, and prevent predatory lending practices.

- To make ends meet – Nearly half of all borrowers said they needed the money to pay bills or buy groceries, including regular bills and utility bills. Many users of payday lending are recipients of Social Security benefits or have bad credit score.

- Pay off debts – More than one in ten borrowers said they had taken out a payday loan to repay another type of debt, such as medical bills or car repairs, or even a previous payday loan.

- Cover emergency expenses – One in twenty borrowers reported taking out a payday loan to cover an emergency expense, such as a broken appliance or a lost job. Unfortunately, many of these people do not have an alternative to payday loans due to their financial situation.

What Is the Cost of RixLoans Payday Loans?

The cost of RixLoans payday loans can be very high compared to other options. Sometimes, the interest rate can be as high as 400%. If you take out a standard two-week payday loan for $100, you could end up paying back as much as $500. Payday loan storefronts and the payday loan industry attract many customers struggling with high-interest debts. Payday loans can also have other fees, such as application fees, that can make them even more expensive, contributing to the growth of the payday loan business.

If you consider taking out a storefront payday loans, you should understand all the costs involved. You could owe even more money if you cannot repay the loan. Payday loans can be risky, so understand all the costs before taking one out in the payday loan market model.

Are Payday Loans From RixLoans Regulated?

The Consumer Financial Protection Bureau regulates payday loans. The bureau is responsible for ensuring that payday lenders comply with the laws and regulations that govern the industry. Payday lenders must follow certain rules when lending money to consumers in a standard two-week payday loan or a standard payday loan arrangement. For example, they must disclose the total cost of the loan to the borrower before the loan is made. They also must provide the borrower with a repayment schedule and cannot charge more than a certain amount of interest on the loan. If a payday lender violates these rules, the bureau can take enforcement action against the lender. Statistics about payday loans help to keep track of such cases.

What Is the Cap on Payday Loans’ Interest and Fees?

When considering the interest and fees, it is important to know about any additional payday loans a person may have. The specific cap depends on the state’s regulations, which may cover the finance charge, loan limits, and other factors. Lenders might require information about your basic expenses, bank statements, and annual incomes to determine if you qualify for a loan. Some states also restrict the number of loans one can have simultaneously, presenting limits for borrowers and financial institutions. Knowing these details is essential to make an informed decision about payday loans.

In the United States, the maximum interest and fees that lenders can charge for a payday loan are regulated by state law. In most states, the maximum amount charged is $15 per $100 borrowed, which equals an annual percentage rate (APR) of 391%. The average two-week payday loan costs $15 for every $100 borrowed.

There are some states with higher caps and some with lower caps. For example, lenders can charge the maximum amount in California at $17 per $100 borrowed.

The high-interest rates and fees associated with payday loans can make them difficult to repay. If you find yourself in a situation where you are unable to repay a payday loan, it is essential to contact your lender as soon as possible to try to work out a repayment plan. If you cannot agree with your lender, you may consider seeking assistance from a consumer credit counseling service.

While payday loans might seem like a quick solution for those looking to make extra money or need to cover living expenses, their high costs mean they are ideal for meeting regular expenses or short-term needs. Borrowers might struggle to repay their loan maximums, and the payday loan interest rates can be significantly higher than those of traditional loans.

Moreover, payday loans often require verification of employment and proof of a steady monthly income or source of income. As a result, these types of loans may not be suitable for those who do not have a stable income or a job that enables them to repay their loans on time.

Instead, consider exploring other options to cover one-off emergencies, such as personal loans or credit cards with lower interest rates. These alternatives also allow for more repayment flexibility and often provide more financial protection than payday loans.

What Happens if You Can’t Pay RixLoans Payday Loans?

If you can’t pay your previous loan, the lender may deposit your check or try to withdraw money from your account. If you don’t have enough money in your account to cover the charges, this could lead to overdraft fees and nagging expenses.

The lender may also try to sell your debt to a collection agency, which could incur additional fees. If you can’t pay your payday loan, contacting the lender as soon as possible is essential to work out a payment plan. If you don’t, you could incur late fees, additional interest, and damage to your credit limits and credit score.

How Many RixLoans Payday Loans Can You Have Out at Once?

Most people who borrow money through payday lenders like RixLoans do not borrow more than three times. If you take out a payday loan for $300, you cannot apply for another loan until you have repaid the first loan. However, there are exceptions. Some lenders allow borrowers to apply for multiple forms of credit simultaneously. The loan use rate and period between loans depend on the lender’s policies and the borrower’s financial situation.

It is important to consider payday loans as a primary source of funds only in case of emergencies rather than a long-term financial solution. Additionally, borrowers should keep track of their loan servicers and maintain good communication to avoid unforeseen issues.

Frequently Asked Questions

What is the current payday loan utilization rate in the United States?

The current payday loan utilization rate in the United States is around 12 million Americans, or 5.5% of the adult population, who use payday loans each year.

How do payday loan usage statistics vary by age group?

Payday loan usage is highest among younger adults, with 13% of adults ages 25-34 using payday loans, compared to only 4% of adults ages 45-54.

Are there any recent trends in payday loan usage among Americans?

Recent trends show a slight decline in payday loan usage, from a peak of 6.5% of adults in 2012 down to 5.5% in 2019, likely due to increased regulation.

What are the main reasons people turn to payday loans in the U.S.?

The main reasons people use payday loans are to cover emergency expenses, pay utility bills, cover unexpected medical costs, repair a vehicle, and avoid overdraft fees.

How does payday loan usage compare across different states in America?

Payday loan usage varies widely by state, from a high of 13% of adults in Mississippi to a low of less than 1% in Maryland where payday lending is prohibited.