A credit score might be available to you in as short as six months, but obtaining outstanding credit can take much longer.

How soon can you improve your credit score? If you need to borrow money but have low credit or no credit score, it may feel like an eternity until your credit score is acceptable to lenders. However, if you make effective changes to your credit management habits, you can see improvements in your credit score in as little as one month.

But how long does it take to establish credit from the start or even to restore credit? What you should know is as follows.

How Much Time Does It Take to Establish Credit From Scratch?

You may not have a credit score for a few reasons. First, you could not have any prior experience with credit; if you have never applied for a loan or obtained a credit card, you have what is referred to as a “thin credit file.” This indicates there isn’t enough data to create your credit score. This may also occur if you haven’t used credit in a long time, are a recent immigrant to the United States, or just went through a divorce or widowhood.

How long it takes to raise your credit score? Building a credit score from scratch takes six months. You must have at least one credit account active for at least six months and one version with activity reported to the credit bureaus during six months. One interpretation could meet both of those conditions.

According to FICO’s third condition for calculating a credit score, there must be no evidence on your credit reports that you are dead. Although it may seem unusual, it might happen if you share an account with someone who has since been pronounced dead. Getting a credit score should take six months if you meet all three criteria. After that, you may focus on the next phase: raising your score.

The FICO Score Ranges Are as Follows:

- Poor: 300-579.

- Fair: 580-669.

- Good: 670-739.

- Excellent: 740–799

- Outstanding: 800-850.

Leslie H. Tayne, a debt settlement lawyer with the Tayne Law Group in New York and the author of the money management book “Life & Debt,” says that the number of accounts you create and the amount of credit you use will determine how long it takes for you to develop excellent credit.

It is difficult to pinpoint a certain period for good credit since it depends on various borrower behavior-related variables. However, you should concentrate on the aspects of your credit score that have the most influence if you want to establish strong credit quickly.

“It’s vital to start on the right foot when you’re initially developing credit, so make sure you can make all of your payments on time every time and aim to pay down your bills in full,” Tayne advises. Starting by overextending yourself will make it more difficult to develop credit.

How Soon Can You Expect Your Credit Score to Improve?

Let’s say your credit score isn’t very good, but you do have one. How long does it take to get excellent credit now? The timetable for raising a negative credit score might be challenging. Much of it will depend on how terrible your credit was. It can take a while to rebuild if there has been significant damage, according to Tayne.

For instance, serious mistakes like a collection account, foreclosure, or bankruptcy will remain on your record for around seven years. However, with time, their influence will diminish. According to FICO, a collection account that is five years old will have a far less negative impact on your score than one that is just five months old.

The Best Ways to Raise Your Credit Score Quickly

You can take action to enhance your credit, whether you’ve never had a credit score before or want to see it rise. Even though it could feel overwhelming, focusing on one area at a time might help you progress.

- Know the score. Without knowing your score, you can’t improve. Check credit bureaus to see whether you have a credit score. You’re entitled to a free credit report from each of the three main agencies once a year at AnnualCreditReport.com. Due to the coronavirus epidemic and the recession, you may receive free weekly notifications until April 25, 2022. Credit reports don’t display your score; contact your credit card provider or consumer services to view it for free.

- Open a credit account. You must get credit to establish your credit score if you don’t already have one. Naturally, it may create a chicken-and-egg problem: how can you get credit if you don’t have a credit score? Thankfully, there are approaches. Try asking a family member to enroll you as an authorized user on one of their credit cards, for instance. You may also apply for a credit-builder loan or a secured credit card, both intended for those with bad or no credit.

- Clean up your credit reports. Numerous inaccuracies on credit reports, such as omitted accounts, erroneous credit limits, and even mismatched Social Security numbers, may lower scores. The best advice is to dispute inaccuracies for a quick boost in your credit score since the credit bureaus are required by law to rectify them.

- You are reducing your use. Reducing your credit usage ratio is one of the quickest strategies to raise your credit score. You may facilitate an existing debt below 30% of your credit limit. However, any decrease in your balance helps. The second option is to request a higher credit limit. The important thing to remember is that you cannot take on additional debt since if you do, your ratio won’t improve.

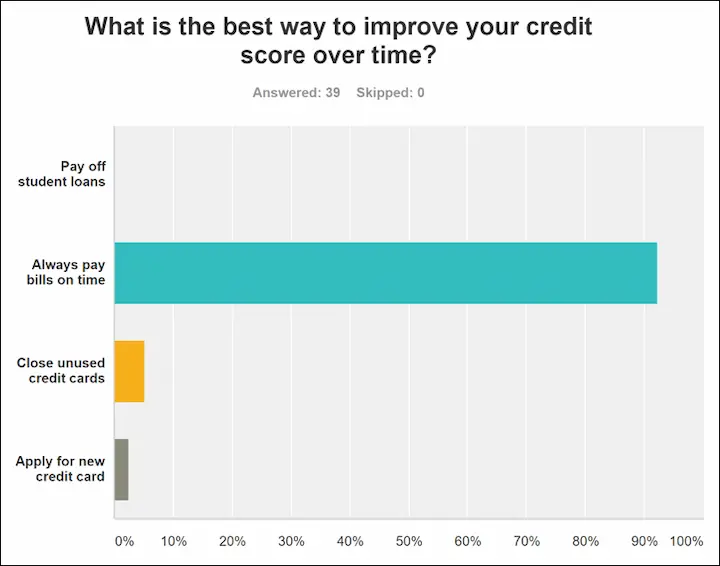

- Make all bills on time. Missing payments is one of the simplest ways to damage your credit. Beneficial consequences will result from making complete and timely bill payments. Your score will rise as recorded payments fade into the past.

- Sparingly apply for new credit. Finally, although applying for additional credit to raise your score might be tempting, be careful not to overextend yourself. By seeking to create (too many) new credit accounts, Best advises, “You will delay the increase of your credit score.” Before adding additional charges, start with a few and carefully maintain them for a year or two.

How to Keep Your Credit Score in the Good Range?

You must continue to cultivate excellent credit habits after you achieve your objective of having a good credit score if you want to retain it. Here are three techniques to keep your score the same or raise it.

1. Keep an Eye on Your Credit Report

Credit reporting mistakes might lower your credit scores, such as giving incorrect payment status and amount. Review your credit report at least once a year to look for inaccuracies. Through May 25, 2022, you may visit AnnualCreditReport.com to get a free copy of your weekly credit report from each credit agency, thanks to Covid-19. You can then examine your credit report once a year for free.

If you find an inaccuracy, submit it to the creditor that reported it or to each credit agency that includes it on your reports.

2. Recurring Bill Payments

The primary component of credit score is payment history. Continue making on-time payments on all your bills to keep your score up. A creditor may report one of your debts to the three main credit agencies if it is 30 days past late, which might seriously harm your credit score.

3. Request New Credit Sparingly

A lender will normally do a rigorous credit check to determine your creditworthiness when you apply for credit. Your credit score may temporarily decline a few points due to each credit check. Only apply for credit when needed to avoid a significant decline in your credit score.

To Sum Up

Generally, establishing credit for the first time takes at least six months; however, it may take longer to establish solid credit. Stay persistent and adopt good credit practices as you select a solid credit profile.

Frequently Asked Questions

What factors influence the speed at which someone can build excellent credit?

Paying bills on time, keeping credit utilization low, minimizing hard inquiries, building long credit history, and correcting errors help build credit faster.

Are there any shortcuts or strategies for quickly improving one’s credit score?

No real shortcuts, but focusing on on-time payments, lowering debt, and not closing old accounts can help improve scores within 6 months to a year.

How long does it typically take to see significant improvements in a credit score?

It often takes at least 6 months of consistent, positive behavior to see a meaningful increase, though the timeline varies case by case.

What role does consistent financial behavior play in the process of building excellent credit?

Consistent on-time payments and low balances demonstrate financial responsibility and are key to building excellent 750+ credit scores over time.

Can negative marks on a credit report be overcome to achieve excellent credit, and if so, how long does it usually take?

Yes, negative marks can be overcome through rehabilitation and time – typically 7 years for bankruptcy/foreclosure and 3 years for late payments.