Arkansas Payday Loans – Bad Credit Near Me

Everyone understands that life is unpredictable, and sometimes unexpected expenses, such as medical bills, arise. If you need funds urgently, Arkansas payday loans via RixLoans may be what you require. With a RixLoans loan request, you begin the process of being connected with a network of lenders, without undergoing an extensive credit verification process when seeking financial assistance. RixLoans helps you access fast funds for those in need. Please note, RixLoans is a loan‐connecting service and not a direct lender; approval is not guaranteed and is subject to individual lender criteria.

Why Choose RixLoans for Your Payday Loan Request?

If you qualify, RixLoans payday loans in Arkansas can connect you with lenders who may offer up to one thousand dollars in fast funds, providing access to funds during financial emergencies. You may submit a loan request online without ever having to leave the comfort of your home through an easy online loan request process. It is a simple, secure method to connect with potential lenders for your financial needs. Furthermore, online lenders often offer flexible repayment options.

What Is a RixLoans Payday Loan in Arkansas?

A RixLoans payday loan is a short-term loan agreement arranged through our network of lenders, designed to provide you with the funds you need, regardless of your credit history. To qualify, you must provide proof of income and have a steady source of income. RixLoans connects you with lenders who offer convenient solutions for those who need financial assistance in a timely manner. Please note that submitting a loan request does not guarantee approval.

Generally, loans are categorized as short-term or long-term. Short-term online loans, which may involve higher costs, are available through our network of lenders via RixLoans in Arkansas. These loan options can be a good solution for clients seeking to borrow money for a short period in exchange for a service fee. They offer limited loan amounts and flexible repayment terms.

For this reason, this type of loan is known as a payday loan. Traditionally, the borrower provides a personal check for the loan amount and the service fee to the lender. Arkansas payday loans allow you to obtain funds promptly, even with less-than-perfect credit. They feature a streamlined process and various loan products for different client needs. Please note that a decision on your loan request is subject to lender review and is not guaranteed.

What Are the Requirements for a RixLoans Payday Loan Request in Arkansas?

A person must meet specific loan requirements to submit a loan request online. The applicants should be:

- At least eighteen years old (full legal age)

- Arkansas residents & United States residents (proof of residency)

- Demonstrating a steady income (with proof of income)

- Providing valid email and phone numbers to complete the loan request

- Having an active checking account

- Meeting the minimum credit score requirement, although bad credit borrowers may still qualify for loan offers based on other factors, such as repayment periods and lender-specific criteria

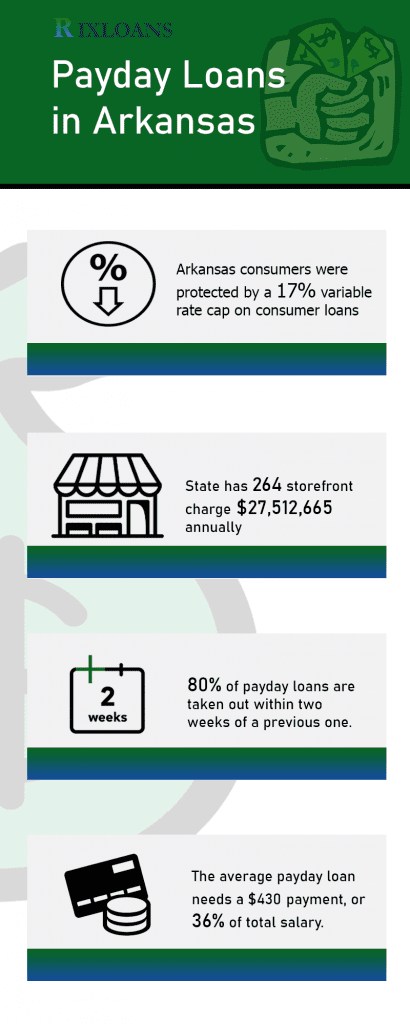

What Are the Payday Loan Rates & Rules in Arkansas?

- Financial advice: Loan renewals & rollovers are not allowed, normally

- Access to funds: One day (24h) cooling period

- Maximum loan: Max loan is limited to $500

- Loan option: One loan per month rule

- Loan contract: $10 to $15 fee for every $100 borrowed

- Flexible repayment plans: Maximum loan duration is 31 days

- Minimum one-week loan

- Loan details: Extra finance fees & costs may apply

Important: Please read and review the loan terms and conditions before committing, so you fully understand your obligations.

How Can I Submit a Loan Request for a RixLoans Payday Loan in Arkansas?

The easiest way is to submit your loan request online, as it is fast, easy, and available 24/7. To submit a loan request for cash loans online, you must meet the fundamental prerequisites (listed above). Review the rates and terms and start the process. The online loan request process at RixLoans typically takes only 5-10 minutes.

How many payday loans can I get from RixLoans?

With a network of lenders providing a range of loan options, access to funds becomes easier. Discover and explore various loan amount options and make informed financial decisions based on your needs.

Consumers in Arkansas are limited to receiving one cash advance per month. They also cannot roll over their debts if they cannot pay them back. Furthermore, no one can get a new loan until they finish repaying an existing one, which takes 24 hours.

Can I Get a Loan with Bad Credit Through RixLoans?

While obtaining loans with a strong credit score is generally easier, you may still be connected with lenders through RixLoans even if you have a bad credit score or poor credit. Lenders often focus on your monthly income rather than your credit history, making it a convenient solution for borrowers seeking emergency funds.

Flexible loan amounts and competitive rates offered by lenders serving bad credit borrowers can make payday loan options a viable solution for those with less-than-perfect credit scores facing unexpected bills.

Payday loans are generally due on the borrower’s next salary, which can make the credit score a less critical factor. While a soft credit check may be conducted, credit scores are not typically reported to credit bureaus in this process. The streamlined process facilitates prompt access to funds, contributing to its popularity, although a higher credit score can still offer additional benefits.

Why Was My Loan Request Denied by RixLoans?

It’s essential to meet all the eligibility criteria when submitting a loan request. If your loan request is denied, it might be due to an insufficient credit profile or not meeting the required criteria. Reviewing your request and ensuring all details are accurate and up-to-date can help improve your chances for future approval.

If you do not qualify for an Arkansas payday loan via RixLoans, there may be several reasons for this decision. The following are some of the most common factors that can lead to an unsuccessful loan request:

- You provided information that is false or erroneous.

- A lack of work experience or a poor employment history

- You did not provide your active bank account details

What Are the Benefits of Using RixLoans to Connect with Lenders?

RixLoans distinguishes itself by offering many advantages through its network of lenders. The following is a summary of its most significant benefits:

- Loan Request in Minutes: Complete our online loan request form and see your loan options quickly, subject to lender review.

- Flexible Terms: Tailor your loan repayment plan according to your needs and situation.

- Steady Source of funds: Connect with lenders who can provide the funds necessary to cover emergency expenses, help manage late payments, and address unexpected financial situations.

- Simple Loan Request Process: Easily submit your loan request and connect with potential lenders through our streamlined process.

- Competitive Loan Options: RixLoans connects you with lenders offering competitive rates, making it a popular option for individuals seeking short-term financial assistance.

- Informed Decisions: Our transparent terms and conditions empower borrowers to make informed decisions about their loans.

- RixLoans loan options may offer affordable monthly payment plans.

- Rates offered through RixLoans’ network can be competitive when compared to other available options.

- RixLoans may connect you with lenders that offer flexible repayment terms, including extended loan durations.

- A standard payday loan is typically short-term, often not exceeding one year, which may be suitable for many borrowers.

RixLoans is proud to connect borrowers with lenders in various cities across Arkansas. We understand the importance of providing accessible financial solutions, especially when unexpected expenses arise. As we work to meet the needs of individuals seeking reliable payday loan options, we have extended our network’s reach to several key cities throughout Arkansas. Below is a table highlighting some of the cities where our network actively connects borrowers with lenders. We are committed to helping residents overcome financial hurdles and achieve their goals.

| Little Rock | Fayetteville | Fort Smith |

| Springdale | Jonesboro | Rogers |

| Conway | North Little Rock | Bentonville |

| Pine Bluff | Hot Springs | Benton |

| Sherwood | Bella Vista | Paragould |

What Are the Drawbacks of RixLoans Arkansas Payday Loan Options?

- Payday loans have high-interest rates (APR)

- Credit scores are not checked or reported to credit bureaus, so they do not help build your credit history.

- If you face prolonged financial difficulties, you risk falling into a cycle of debt

RixLoans – Your Convenient Connection to Lenders for Payday Loan Requests

Everyone has experienced a situation where funds are needed to bridge a gap between paychecks. RixLoans can assist by connecting you with reputable lending sources when you’re unsure where to turn for assistance. Our online platform connects borrowers with lenders offering payday loan options with fast responses.

Whether you need extra funds to cover unexpected expenses or bridge the gap between paychecks, our online cash advance options can be a viable solution for you. Submit your personal details through our secure loan request process and receive a response promptly. With RixLoans, you can access funds for emergencies quickly and conveniently.

With a range of options available, you can find a suitable plan to cover any gaps between paychecks that may arise from unexpected medical expenses or other financial challenges. Repayment terms can vary, with some lenders offering options that range from two weeks to thirty or more days, depending on your circumstances.

Filling out loan request forms is easy, and the entire process can be completed in just a few minutes. Say goodbye to lengthy application procedures, as many lenders require only minimal and basic information to review your request promptly.

By submitting your loan request online, you’ll be connected with potential lenders promptly, enabling you to make an informed borrowing decision. Flexible eligibility requirements mean that you can secure the funds you need without unnecessary delays.

Conclusion

In the realm of payday loan regulations, Arkansas has opted for a moderate stance. The state has set the payday loan APR at a maximum of 300%, which, while lower than in states such as Texas, Oklahoma, Missouri, and Mississippi (which have no caps), is still relatively high compared to other states. Advocates continue to work towards reducing these rates, although some lenders stress the need for slightly elevated caps to ensure accessibility. Additionally, the state restricts residents to only five payday loans per year. As discussions on the optimal regulatory approach persist, various short-term financing options remain available in compliance with current regulations.

Frequently Asked Questions

Are payday loans in Arkansas legal, and what are the regulations surrounding them?

Yes, payday loans are legal in Arkansas with some regulations. Lenders must be licensed, loans cannot exceed $400, fees cannot exceed 17% of the loan amount, and loans must be due in 14–31 days.

How do I submit a loan request for a payday loan in Arkansas without a credit check?

You can submit a loan request in person at a payday lender with proper ID, proof of income, and a bank account. Online loan requests typically require ID, income information, and account details. A hard credit check is not required, although a soft check may be performed.

What is the maximum loan amount I can receive through a payday loan in Arkansas?

The maximum payday loan amount allowed in Arkansas is $400. Lenders cannot legally issue a payday loan exceeding $400.

What are the typical interest rates and fees associated with payday loans in Arkansas?

Typical APR on Arkansas payday loans is 391% with maximum fees of $45 on a $350 loan. This equals 17% of the loan amount, which is the maximum allowed by law.

Are there any alternatives to payday loans in Arkansas for obtaining emergency funds in a financial crisis?

Alternatives include pawning items, borrowing from friends or family, using credit cards, employer cash advances, credit union loans, and negotiated bill payments.