Financial Tips for Beginners

Types of Loans and How to Choose Them

Knowing the different types of loans available to you is essential when looking for a loan. Common loans include personal loans, mortgages, and auto loans. Two popular options suitable for people with a poor credit history are payday loans and online loans. Some may opt for cash advance loans in emergencies. In contrast, others may use a source of income such as a credit card to cover unexpected expenses. Consider factors like loan interest rates and finance charges to determine the most appropriate loan.

Determining Loan Amounts

To better manage your financial situation, decide on the appropriate loan amounts. Remember that borrowing too much may increase your finance charges, making it harder to repay the loan. Consider your current financial capacity and look for alternatives like friends or family before deciding on a loan.

Finding the Right Payday Loan Store

Not all payday loan stores are created equal. Compare different stores by their loan interest rates, finance charges, and repayment terms. Verifying that the store operates legally and is licensed within your state is also vital.

Importance of a Steady Source of Income

Having a steady source of income is crucial when applying for loans, as lenders prefer borrowers who can prove consistent earnings to assure repayment. If you currently need a reliable income, it might be best to wait to apply for a loan until you can secure a stable job or other sources of earnings.

Understanding Finance Charges

Finance charges are the fees a lender imposes on borrowers in exchange for the borrowed money. They usually include loan interest rates, credit check fees, and other loan-related charges. Awareness of these charges is crucial to avoid being caught off-guard by unexpected costs.

Managing Your Credit Card Responsibly

A credit card can be a beneficial financial tool if used wisely. Paying your balance in full each month is crucial to avoid accumulating debt and incurring high finance charges. To make the most of your credit card, also be mindful of its interest rates and always strive to maintain a good credit score.

You can better manage your financial future by proactively understanding the types of loans, loan amounts, and the importance of having a consistent source of income. Additionally, always be conscious of finance charges and responsibly manage your credit card spending.

Receiving benefits is a challenging and isolating experience. Obtaining a payday loan must not add to the struggle but rather offer an opportunity for people in need to take charge of their financial situation. RixLoans explores the question of obtaining a payday loan while on benefits. It seeks to shed light on the subject matter, providing readers with insights into what options are available for individuals hoping to secure such loans. The idea of obtaining a loan when already receiving government assistance seems daunting. There is no need to fear as various regulations are in place to make such an option more accessible. Such laws exist federally and locally, ensuring potential borrowers are properly protected. Several non-profit organizations offer support by helping individuals understand how the loans work and highlighting any potential risks involved.

Online payday loans through an online lender or a direct lender can be a viable option to consider quickly. With this service, individuals can receive access to money with fewer barriers compared to traditional loans.

What Is A Payday Loan?

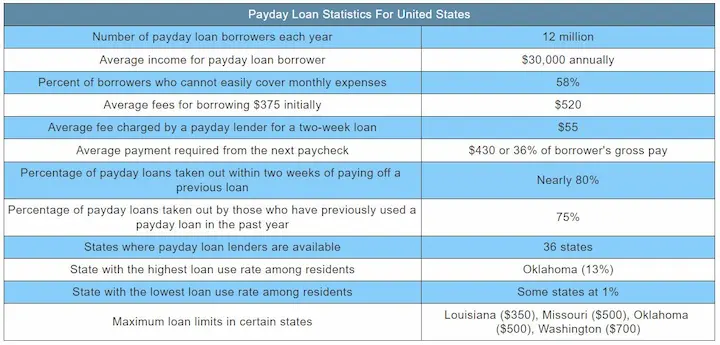

Obtaining a short-term loan to cover unexpected expenses is the perfect solution in times of financial difficulty. The thought of a payday loan conjures up an image of cash advances and quick money when needed most. Still, individuals must understand how such loans work before committing to one. Over 80% of payday loans are rolled over or followed by another loan within 14 days, according to SSRN. The table below sheds more light on the data.

When borrowing from a reputable payday loan company, one can expect professional assistance and payday loan services. These companies usually have an active checking feature, which ensures the borrower can repay the loan within a specified period, usually on their next business day. Sometimes, customers may even use a personal check to secure the loan.

Remember to explore different options like an online lender or a direct lender for better loan deals when dealing with a payday loan company. Always try to make informed decisions to manage your finances and overcome the struggles of unexpected financial difficulties.

Borrowing PatternPercentage of Borrowers

Loans rolled over or followed by another loan within 14 days (two-week loans) Over 80%

New loans followed by a bad credit loans sequence at least 10 cash loans long 15%

Loans in a sequence of unsecured loans at least ten loans long, 50%

Last loan in a sequence the same size or larger than the maximum loan amounts of the first loan Over 80%

Monthly borrowers staying in debt for 11 months or longer (monthly payment) 22%

The proportion of monthly income borrowers who are government benefits recipients Majority

Borrowers with only one Check Loans sequence during the year 48%

Borrowers who took out only one quick cash loan during the year 60%

Using deposit loans as a way to solve financial challenges Variable

Payday loan patterns

A payday loan is a high-cost, short-term credit product given to borrowers who need access to funds quickly. The idea behind it is that the borrower repays the loan on or around their next pay date. It means that the lender charges higher interest rates than regular lending products. Payday loans have shorter repayment terms, known as same-day or instant loans. Borrowers exploring payday loans must know that payment failure has serious consequences, including increased fees and collection activity.

What Are The Benefits Of Obtaining A Payday Loan?

Obtaining a payday loan gives individuals access to necessary funds in times of need. Payday loans are short-term, high-interest loans that allow borrowers to receive cash quickly and easily when facing financial difficulty. The loans carry higher interest rates than traditional bank loans. Still, they have certain advantages that make them appealing to people who require quick access to capital. One benefit of obtaining a payday loan is the convenience it offers. The process takes only minutes and requires minimal paperwork or credit checks. As with most lending institutions, it allows borrowers to get the money they need in days rather than weeks or months. Most lenders offer online applications, so customers don’t even have to leave the comfort of their own homes during the application process. Many payday lenders do not consider an individual’s credit history when deciding whether to lend money. Instead, they focus on current income sources such as wages from employment or benefits from government programs like Social Security or unemployment insurance. People who do not qualify for other forms of financing due to poor credit scores still have access to a payday loan if they meet the lender’s criteria.

How Much Do Payday Loans Cost?

Payday loans are attractive for people seeking immediate access to funds. Still, it would help if you took the cost of such short-term borrowing solutions seriously. Cash advances have a fee based on the amount borrowed and usually equate to an annual percentage rate (APR) of 300% or more. Anecdotally, one borrower found themselves in over their head after obtaining a payday loan when they could not pay back the full balance by the end of the month. Individuals in such situations usually find themselves trapped in a cycle of debt due to high-interest rates and fees associated with refinancing or extending repayment terms.

Are There Any Restrictions On Who Can Get A Payday Loan?

Have you ever wondered what restrictions lenders place on payday loan applicants? Payday loans, known as cash advances, are short-term financial solutions that n help individuals with immediate expenses. Borrowers must understand the limitations of who is eligible for such loans before applying. Here are a few key points to review. Who provides the loans? What qualifications must borrowers meet? Are there any age limits or special needs? Does the lender allow people on benefits to obtain a payday loan? Are there any other criteria to take into account? Financial institutions offering payday loans have strict guidelines and regulations regarding approval. Lenders usually require proof of income to qualify for a loan. It includes pay stubs from an employer or copies of government documents proving eligibility for social security benefits. Many providers require applicants to meet certain credit score requirements before approving their application. Generally, it means having at least fair credit (620 or higher). Various lenders even impose age restrictions, meaning only borrowers over 18 years old apply.

What Should I Consider Before Getting A Payday Loan?

Payday loans are only suitable for some and cost more in the long run than initially expected if you meet certain requirements. Obtaining a payday loan is enticing, but borrowers must know the implications before taking such a step. Here are four key steps to enable you to make an informed decision.

1. First, you must understand the costs associated with your loan and how much interest accumulates over time. Understand that most payday loans have high-interest rates, which lead to spiraling debt, so try to pay them off within the specified repayment period.

2. Secondly, know the hidden charges or fees that increase the amount payable. Most of the fees usually go unnoticed until it’s too late.

3. Thirdly, check if you meet all eligibility criteria required by lenders. Missing out on even one criterion results in being declined for a loan, so double-check all information provided when applying.

4. Lastly, evaluate alternative options such as setting up budget plans or contacting local charities offering financial advice before proceeding with a payday loan. Asking loved ones for help is worth exploring if no other option is available.

What Are The Alternatives To Payday Loans?

Alternatives to payday loans include credit unions, government assistance programs, pawnbrokers, and even family or friends. Credit unions offer small personal loans at competitively lower interest rates than other lenders like banks and online providers. Government assistance programs exist in most countries, providing funds for people who qualify based on their specific circumstances. Pawnbrokers are an option as they usually lend money against items you own without taking ownership of them. If available, asking friends or relatives to help you is a viable option. No matter your financial situation, research and understand the terms before committing to any loan agreement, including payday loans or alternative forms of lending. Research all available avenues thoroughly to make an informed decision and choose the best one for your needs.

How Do I Know Which Option Is Best For Me?

The first step in finding alternatives to payday loans is identifying the type of loan best meets your needs. Knowing which option is right is difficult, so you must research and understand all available options before deciding. Many alternative finance products work for people receiving benefits, including installment loans, credit builder loans, or peer-to-peer lending. There are local organizations such as charities or non-profit groups that offer no-interest loans or grants for people on low incomes. Each of the options has its own set of pros and cons, so borrowers must take time to review each one carefully to make an informed decision about which is the most suitable.

What Are The Legal Implications Of Obtaining A Payday Loan?

Borrowers must understand the potential consequences when reviewing the legal implications of payday loans. Many individuals usually obtain a loan without reviewing what happens if they do not make payments in time or break other agreement clauses. Taking a step back and objectively assessing the situation helps one to make an informed decision before proceeding with any loan process. The details of such agreements vary from lender to lender, so researching local regulations and laws regarding short-term financing is necessary before signing up for such a product. Knowing your rights when agreeing is beneficial if there is a dispute between the borrower and the lender. For example, many states limit how much interest lenders charge borrowers. Understanding what counts as usury gives you further insights into your responsibility under such contracts. Familiarizing yourself with debt collection practices is another necessary precaution to enable all parties to adhere to their obligations throughout the contract. Payday loans offer relief during financial hardship but come at significant risk when taken lightly or without adequate research beforehand. Understanding current legislation governing the loans and knowing about relevant consumer protection measures is key in enabling one’s responsibilities to remain within manageable limits before committing to any repayment plan.

What Should I Do If I Have Trouble Repaying A Payday Loan?

Payday loans have become increasingly popular as many seek quick and easy access to funds. The repayment process proves difficult due to high-interest rates and other factors. Borrowers must understand what to do if they need help to repay a payday loan. First and foremost, communication with the lender is key. Payday lenders tend to have more flexible payment plans than traditional banks and credit unions. It allows borrowers extra time to pay off their loans without being faced with exorbitant late fees or penalties. It helps to keep track of all paperwork associated with the loan so that one provides accurate information about payments made thus far when speaking with their lender. There are numerous consumer protection agencies available which offer assistance for people having trouble repaying their payday loans. The organizations help negotiate lower interest rates or advise how to handle the situation depending on individual circumstances.

How Can I Find A Legitimate Payday Loan Lender?

Finding a reputable payday loan provider requires effort on behalf of the borrower. There are various ways to assess if a company is trustworthy. One way is by looking at customer reviews from past borrowers, which offer insight into how other people experienced using the service. Prospective customers must check if the lender has an active license with their local state’s financial regulator and investigate any complaints against them filed with government organizations such as the Consumer Financial Protection Bureau (CFPB). Comparing interest rates across different lenders is useful, ensuring they are consistent with market averages and do not contain hidden fees or charges associated with repayment terms. Researching each lender’s customer service policies helps to confirm what type of assistance they provide when borrowers experience difficulties repaying their loans. Taking such steps allows consumers to decide which payday loan provider best meets their needs and helps protect them from unscrupulous practices.

Conclusion

While beneficial in various circumstances, using payday loans is fraught with complications. Borrowers must understand the legal implications and potential risks of obtaining a payday loan, especially if one receives benefits. People exploring a payday loan must research reputable lenders and compare their terms before signing any agreement. Payday loans provide fast access to much-needed funds. Still, borrowers must know of all costs involved and any restrictions on who applies. There are advantages and disadvantages to obtaining such a loan. It is up to each borrower to decide if they feel comfortable entering such a financial arrangement.

Frequently Asked Questions

Is it possible to get a payday loan while receiving government benefits?

Yes, it is possible to get a payday loan while receiving government benefits like Social Security, disability, unemployment, or welfare as long as you have proof of income from the benefits.

What are the eligibility requirements for obtaining a payday loan if I’m on disability benefits?

The requirements are proof of regular disability payments, an active checking account, government-issued ID, and being at least 18 years old. Your credit score is generally not checked.

Are there any restrictions or limitations on the amount I can borrow in a payday loan while on unemployment benefits?

There are typically limits on payday loan amounts while on unemployment such as a maximum of $500 or one-third of your monthly unemployment check. The specific limits depend on state regulations and lender policies.

Do payday lenders consider my Social Security or retirement benefits as a source of income for loan approval?

Yes, payday lenders do view Social Security, SSI, and other retirement benefits as verifiable income sources for determining your ability to repay the loan, which can help with approval.

What are the potential consequences of taking out a payday loan while receiving welfare or food assistance benefits?

Potential consequences include reduced benefits if the loan payment decreases your welfare income, high fees and interest diminishing aid money, risk of overdraft fees if loan due date coincides with assistance deposit, and getting caught in predatory lending cycle.