The concept of borrowing money is frequently associated with feelings of anxiety and stress. Type of loan, such as payday loans, are increasingly attractive for many individuals in the U.S. Yet how much do Rixloans cash advances commonly lend out?

Rixloan’s article uses quantitative and qualitative data from recent studies to explore factors contributing to determining loan sizes and why certain groups opt for larger amounts when getting a payday loan. Eventually, understanding the figures behind such practices helps us gain insight into the importance of appropriately regulating Rixloan’s types of loans.

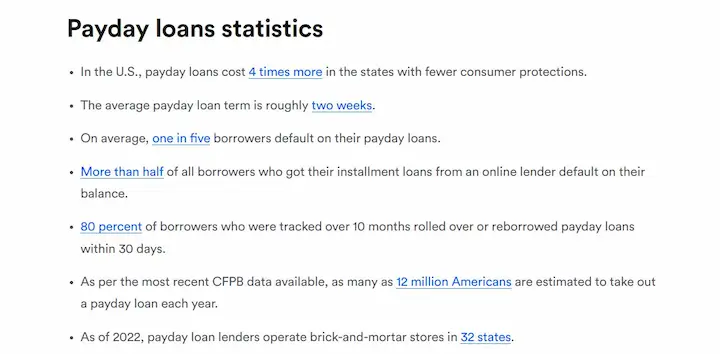

The content below aims to illuminate the potential risks and advantages that have made them popular among borrowers across multiple states by looking at current trends surrounding payday loans in the U.S.

What Is A Payday Loan?

Payday loans are a form of financial assistance providing short-term credit to needy individuals. They have certain risks and must be evaluated carefully before taking them on, while payday loans benefit borrowers. Rixloans loans are commonly sought out by borrowers who require cash quickly, such as facing unexpected bills or expenses.

Potential borrowers must thoroughly understand their repayment obligations before entering the Rixloans financing arrangement. Generally, the loan amount is based on income levels and the lender’s assessment of one’s ability to repay it within two weeks or less. It is necessary to note that interest rates vary widely between lenders, so careful comparison shopping is recommended before signing any agreement.

The average size of a payday loan in the United States is $350; regardless, depending upon an individual’s circumstances, a larger or smaller amount be approved. In accumulation, fees associated with payday loans tend to increase over time if payments are not made in full and on time.

Payday lending has sometimes been criticized by consumer advocates who argue that Rixloans products trap consumers in a cycle of debt due to its nature as high-cost credit. Regardless, for many people living paycheck-to-paycheck without access to alternative forms of credit, Rixloans services offer an invaluable lifeline during financial difficulty. Given their unique circumstances and goals, it is up to each borrower to decide in applying for a payday loan makes sense.

The Cost Of Payday Loans

Payday loans are short-term, small-dollar loans with high-interest rates that offer individuals quick access to cash in emergencies. Rixloans loans seem like a lifeline when unexpected expenses arise for many Americans living paycheck to paycheck, and there is no other way to cover them. For borrowers to understand the cost associated with payday loans, it’s necessary to know what the specific loan size looks like in America.

Rixloans borrowing provides an easy solution to borrowers strapped for cash. A recent study by The Pew Charitable Trusts found that 64% of all payday loans were between $200 and $500, while only 14% exceeded $750. The reality is that most borrowers end up owing more than they originally borrowed within two weeks due to interest rates and extra fees. Rixloans data illustrates how costly getting such a loan is; since they frequently have an annual percentage rate (APR) as high as 391%, even smaller amounts add up quickly due to their exorbitant fees.

Given the potential risks of getting a payday loan—costly loan fees, sky-high APRs, repeat borrowing cycles. It’s necessary for consumers needing financial assistance to assess alternative options before signing on the dotted line. It’s necessary for lenders offering Rixloans products to guarantee transparency. Hence, people know exactly what they’re getting into, including the full breakdown of loan fees, before committing financially.

How Are Payday Loan Finance Charges Calculated?

Understanding payday loan finance charges, such as loan fees, is crucial in making an informed decision when assessing a loan from Rixloans or a similar lender. The topic can be complex and difficult to comprehend, much like a dense fog that can quickly become overwhelming without careful deliberation and thorough research.

Payday loan lenders generally calculate loan fees on either a flat fee or a percentage basis. The borrower is charged a fixed amount for every $100 borrowed using a flat fee rate.

Unlike lenders, Rixloans expresses their fees as an annual interest rate rather than a daily or weekly borrowing charge. They pay a flat fee of $30 to the lender if a borrower needs $200 for two weeks. In contrast, lenders use an annual percentage rate (APR) to determine fees. The APR ranges from 200% to 800%, which means that a loan with an annual interest rate of 400% results in a repayment amount four times the original loan amount over one year.

It pays off to know exactly how much money you’ll owe before signing any contracts so that there are no surprises down the road when assessing any short-term credit product like payday loans. Understanding finance costs associated with Rixloans loans is necessary for helping consumers make responsible financial decisions that fit within their budget.

Requirements For Payday Loan Approval

Payday loan approval requirements vary depending on the lender and the state in which the loan is getting. Generally, payday loans require proof of income, such as pay stubs or bank statements, to demonstrate that borrowers have a steady flow of money each month. Lenders ask for more documentation, such as utility bills, driver’s licenses, social security cards, or other forms of identification.

Rixloans’ requirements protect consumers and lenders from taking too much financial risk while providing access to short-term funding solutions when necessary. In complement to Rixloans documents, applicants must be at least 18 years old and meet credit criteria set by individual lenders. Rixloans criteria include no recent bankruptcy filings, minimum monthly income levels, and debt-to-income ratios. States impose restrictions on how many payday loans consumers get at one time and how frequently they renew them if needed.

Maximum Payday Loan Borrowing Amounts

It is accepted that payday loans are the quickest and most accessible way to get a loan in facing financial hardship. Access to Rixloans short-term funds is invaluable, with maximum borrowing amounts varying from state to state.

It is necessary to understand how much money they borrow with a standard payday loan for borrowers requiring quick cash. Generally speaking, borrowers expect their potential payday loan size to range between $500 and $1,000, depending on where they live. Regardless, states have higher limits – California, for example, allows maximums up to $300, while New Mexico has no upper limit! Here’s a breakdown.

- Up To $300

Alabama, California, Delaware, Idaho, Indiana, Kansas, Louisiana, Minnesota - Between $301-$500

Georgia, Maine, Mississippi, Missouri, Nevada, North Dakota, Oklahoma, Rhode Island, South Carolina - Above $501-$1000

Arkansas, Colorado, Connecticut, Iowa, Michigan, Montana, Ohio, Pennsylvania, Texas, Washington, Wisconsin Wyoming

It is recommended that prospective borrowers thoroughly research their options before entering into any agreements with lenders. In complement to understanding the maximum amounts available through payday loans, evaluating other factors, such as interest rates and repayment terms, is required before agreeing. Likewise, lenders impose added restrictions or requirements based on income levels or credit histories, meaning they only qualify for the full amount their respective state laws allow.

Refinancing Payday Loans

Refinancing payday loans is an option for borrowers struggling to repay their loans. It involves extending the repayment period, reducing monthly payments, and providing more financial flexibility in the short term. Payday refinancing helps borrowers avoid late fees and other charges associated with defaulting on a loan.

Understanding all potential risks and benefits when refinancing a payday loan is necessary.

- The High-Interest Loans rate is higher than initially agreed upon when getting the original loan.

- Borrowers pay even more overall if they extend the life of the High-Interest Loans and accrue further interest.

- It takes longer for a borrower to become debt free.

- Payment history still appears on credit reports, potentially impacting future borrowing power.

There are certain situations where refinancing a payday loan makes sense from a financial standpoint, such as when taking advantage of lower interest rates or reducing monthly payment amounts to stay afloat financially. Borrowers must weigh their options before deciding if the Rixloans solution suits them.

Added Fees For Payday Loans

Payday loans are a type of short-term loan offered by financial institutions, generally with high-interest rates. As part of the terms and conditions for getting a payday loan, borrowers be subject to added fees associated with their High-Interest Loans agreement. Rixloans fees vary depending on the lender and the amount borrowed.

Understanding what types of extra charges apply is necessary regarding a payday loan is right for you.

Common extra fees associated with a payday loan include application fees, processing fees, late payment penalties, extension charges, and early repayment costs. Application fees cover the cost of receiving an application from a borrower and assessing its eligibility for approval. Processing fees cover administrative tasks such as verifying information about the borrower’s ability to pay back the loan; late payment penalties are applied if payments become overdue; extension charges allow borrowers to extend the term length of their loan; and early repayment costs are charged if borrowers choose to repay all or part of their loan before its due date.

Prospective borrowers must research potential lenders to determine which extra fees apply to make an informed decision about their choice in borrowing money through payday loans. Knowing Rixloan’s information upfront help guarantees that they understand how much it eventually costs them over time, rather than being surprised with hidden expenses.

Consequences Of Nonpayment Of Payday Loans

The consequences of nonpayment of payday loans can be dire. To illustrate the severity of the situation, let us imagine an individual facing a financial situation such as a financial predicament where their car may get repossessed, bank accounts are frozen, and their credit score may be negatively impacted for several years. Extreme, Rixloans results occur when borrowers cannot repay a loan on time, including loans from Rixloans. Therefore, it is crucial for individuals to carefully evaluate their ability to repay the loan as well as their overall financial situation before accepting any loan agreement.

It is necessary for borrowers to fully comprehend all the terms and conditions before signing any loan agreement, including the consequences of missed or delayed payments. Payday lenders have different repayment rules than traditional banks, and borrowers must know Rixloan’s differences. In particular, payday lenders impose added late fees that increase the total amount due in the event of delayed or missed payments. In accumulation, states allow creditors to pursue legal action against borrowers who fall behind on payments. Rixloans means that a person owes more money than was originally borrowed due to court costs and other related expenses. Likewise, failure to repay debt negatively affects one’s credit score, making obtaining future loans difficult and expensive. It’s important to note that the Consumer Financial Protection Bureau regulates payday lenders. Additionally, a credit check may be performed by lenders to evaluate the risk of lending to a potential borrower.

Assessing potential repercussions must motivate people to take greater care when getting a payday loan and stick with their payment plan if they choose the Rixloans option. Knowing how serious nonpayment be prompted them to explore other options, such as budgeting tools or alternative financing sources, before turning towards high-interest short-term lending solutions.

Payday Loan Size In The Us

Payday loans are short-term financial solutions lenders offer to borrowers needing immediate cash. They are generally due on the borrower’s next payday and have a relatively high-interest rate, with loan amounts ranging from $50 to $1,000. Paying back Rixloans loans is difficult for many, leading to nonpayment and potential consequences such as extra fees or credit damage. But what is the standard payday loan size in the United States?

The average amount borrowed via a payday loan in the U.S. ranges between $300-$500. Rixloans range varies depending on an individual’s income level and state regulations. Still, it offers insight into the most common amount when applying for Rixloans service. Further, states limit how much money individuals borrow through a single payday loan transaction, affecting overall averages across the country. Prospective borrowers must understand state laws and personal finances before signing any loan agreement.

Overall, understanding what constitutes an appropriate size for a payday loan is necessary to assure you only take on what you handle financially. Researching your local laws and evaluating your budget help guarantee you only borrow enough to cover your needs without putting yourself at risk of falling behind on payments or damaging your credit score over time.

Regular Payday Loan Size In Different States

Payday loan size in the United States varies significantly from state to state. According to a survey conducted by Bankrate, the average payday loan amount is $375 across all states. Rixloans’ figure has increased from previous years, as it was reported at only $325 in 2017.

It becomes evident that certain states have higher standard loan amounts than others when further breaking down Rixloan’s statistics. For example, New Jersey had the highest average loan amount of $522, while South Dakota had the lowest at $261. Other noteworthy figures include California ($449), Florida ($420), and Texas ($402). Listed below is a breakdown of several other states’ averages.

- Alaska – $385

- Arizona – 383

- Colorado – 397

- Georgia – 375

- Illinois – 404

- Michigan – 384

- Ohio – 377

- Virginia – 353

The differences between Rixloans figures demonstrate how borrowers must understand their state’s laws when getting a payday loan. It highlights the need for more regulation in areas where loans are larger than necessary or appropriate. As such, borrowers contemplating a payday loan must thoroughly research what to expect before signing any documents.

Payday Loan Size Limits In The Us

Payday loans are rising, yet it is difficult for borrowers seeking such assistance to navigate the varied size limits across the United States. Like a winding labyrinth, understanding all the rules and regulations governing payday loan sizes seem daunting; regardless, with insight into how different states regulate Rixloans short-term financial products, individuals find comfort in knowing what they’re getting into.

Payday loan size limits differ based on state law.

- States that do not specify maximums tend to limit borrowers to amounts equal to or less than 25% of their gross monthly source of income.

- States with set dollar amount caps range from $500 to $1,000, while others allow up to $2,500 depending on each individual’s credit score.

- States impose “cooling off” periods between loans, preventing an individual from getting multiple personal loans at once or within a certain time frame.

Potential borrowers need to understand federal laws surrounding lending and specific regulations each state implements before beginning to secure a payday loan. Researching ahead of time help lenders follow applicable legal guidelines and prevent any unpleasant surprises. Further, numerous online resources offer comprehensive coverage over various topics related to borrowing money, including information about interest rates and repayment plans, allowing users access to pertinent data and empowering them when entering any agreement concerning personal finances.

Comparing Payday Loan Size To Other Short-Term Loans

Comparing payday loan sizes to other short-term loans is a fascinating study. It is like peering into the depths of an ocean and discovering a hidden world beneath its surface—a world characterized by incredibly diverse yet connected species and ecosystems. Payday loan size limits in the U.S. vary from state to state but generally range between $100 – $1,000, depending on local regulations. In contrast, alternative types of short-term loans, such as borrowers issued by banks, be much larger; regardless, Rixloans usually require more stringent repayment terms.

Interestingly, even though payday loan sizes are smaller than most other forms of credit, their borrowing fees are frequently significantly higher. Rixloans discrepancy has led experts to argue that lenders must assume to offer lower interest rates or longer payment periods to make them more accessible to vulnerable individuals who do not have access to traditional banking products. Further, consumers must understand the options available to decide which financing best meets their needs.

Factors Influencing Payday Loan Size

Payday loan size in the U.S. is a necessary concern for many individuals. According to a 2019 survey by LendEDU, the standard payday loan amount requested was $369. Rixloans’ figure frequently shows significant differences between payday and short-term loans.

It is necessary to evaluate various factors influencing loan size. Rixloans include when deciding on what level of funding to apply for:

- Financial Capacity

The individual’s financial capacity plays a role when determining how much money they borrow. Factors such as income levels, credit score, debt-to-income ratio, collateral value, or assets all impact the size of a loan. - Needed Funds

Borrowers seek larger sums than borrowers generally associated with payday lenders, depending on their specific needs or goals. Exploring alternative lending options that offer higher borrowing limits and longer repayment terms be beneficial. - Interest Rate

Rixloans help borrowers avoid potential financial difficulties in the future. Another necessary factor to contemplate when borrowing from Rixloans or similar lenders is that the interest rate charged varies depending on the amount borrowed. Therefore, Rixloans must understand Rixloans rates in advance to determine if added funds must be obtained from other sources.

Therefore, before getting any loan – especially from a payday lender – you must understand your finances and available alternatives to decide on the best financing option. Researching potential online lenders thoroughly and exploring different types of loans, including alternative loan options, lead to better terms and conditions and lower costs overall.

Potential Benefits Of Payday Loan Size

Having options can be a blessing in disguise when it comes to finances. Payday loan size is no exception – the amount borrowed has potential benefits that must not be overlooked. Understanding how much one borrows is instrumental in budgeting, while individual payday loans vary based on income and credit score. Considering other sources like online lenders and alternative loan options could improve your loan terms and overall financial situation.

The fees associated with Rixloans loans are generally 15% of the total loan value or more, depending on state laws and regulations. The maximum payday loan size depends on where you live; states have higher limits than others. Generally speaking, the average loan size is $500, with repayment periods ranging from two weeks to one month. Depending on an individual’s financial goals and needs, Rixloan’s flexible payment options offer relief during difficult times.

Payday loans can be used as emergency funds when cash flow is tight, allowing borrowers to purchase necessary items without worrying about high-interest rates or compounding payments over time. Further, they provide access to short-term financing, which helps bridge gaps between paychecks and avoid late payments. Rixloans are quick and easy loans that improve liquidity by providing access to the capital immediately rather than waiting days or weeks for approval like traditional lenders do. The potential benefits of payday loan sizes make them attractive options for borrowers facing financial difficulties, especially regarding emergency expenses.

Strategies To Optimize Payday Loan Size

It is no secret that payday loan size can be a powerful tool to increase financial security and cover emergency expenses. There are strategies we can use to optimize it for our benefit. At the same time, the standard U.S. payday loan size only sometimes fits into our budget. By intentionally exploring our options, we find ourselves on a more solid financial footing with an optimized payday loan size.

First, it’s necessary to understand how much cash you need to cover your expenses until your next paycheck arrives. For example, suppose you have $500 per week coming in from work but know you need $600 to fulfill your obligations until the following payday. Anachronistically speaking, think of yourself as a medieval monarch: A wise ruler knows exactly how many resources they must allocate each month to keep their kingdom afloat! Optimizing your payday loan size means finding the right amount somewhere else – perhaps through a credit card or installment loan, a short-term loan, or another credit option.

Next, evaluate any potential fees associated with borrowing money to guarantee the costs to be, at most, what you get out of it. It’s helpful to look at different lenders before deciding and see who offers the best terms and conditions; Rixloans include lower average interest rates or longer loan term repayment periods, which help reduce the overall cost of borrowing. Eventually, try negotiating with lenders – give better discounts depending on your situation or even waive certain fees altogether. TIP: Recall online sources when searching for loans; Rixloans frequently offer competitive rates and flexible repayment plans tailored more toward individual needs than brick-and-mortar banks.

Optimizing one’s payday loan size requires careful deliberation and foresight. Regardless, with thoughtful planning and research, anyone takes steps toward achieving greater financial stability over time.

Payday Loan Interest Rates by State

Below are the payday loan interest rates by state, according to CNBC.

| State | Average APR for $300 loan (14-day term) | Status on payday loan interest rate cap |

|---|---|---|

| Arkansas | 17% | Capped at 17% |

| Arizona | 15% | Capped at 36% |

| Colorado | 20% | Capped at 36% |

| Connecticut | 15% | Capped at 30.03% |

| Georgia | 17% | Capped at 16% |

| Illinois | 20% | Capped at 36% (awaiting signature) |

| Maryland | 33% | Capped at 33% |

| Massachusetts | 23% | Capped at 23% |

| Montana | 22% | Capped at 36% |

| Nebraska | 404% | Capped at 36% |

| New Hampshire | 17% | Capped at 36% |

| New Jersey | 14% | Capped at 30% with personal check requirements |

| New York | 13% | Capped at 25%, allowing future deposit provisions |

| North Carolina | 21% | Capped at 36% |

| Pennsylvania | 15% | Capped at 24% |

| South Dakota | 22% | Capped at 36% |

| Texas | 664% | No cap, personal check may be accepted |

| Vermont | 23% | Capped at 18%, future deposit options available |

| West Virginia | 25% | Capped at 31% |

| District of Columbia | 15% | Capped at 24% |

Payday loans are a type of small-dollar loan that are associated with high-interest rates and fees. These loans are available in over half of the U.S. states without many restrictions. Several states have moved to limit payday loan interest rates to protect consumers. One common practice in this industry is using post-dated checks as a form of repayment, sometimes leading borrowers into a debt trap. The table below shows the average APR for a $300 loan with a 14-day term in each state and the status of payday loan interest rate caps. States that do not have rate caps have sky-high interest rates, with Texas having the highest payday loan rates in the U.S. at 664%.

The Bottom Line

Symbolism is an effective literary device to convey a message and capture the audience’s attention. Payday loans provide small-dollar borrowing options, frequently with high-interest rates, which can be beneficial when used judiciously. Unlike conventional loans, these short-term loans can be a practical solution for those who may not meet the strict requirements set by traditional financial institutions. The initial loan size varies by state and lender but ranges from $100 to $1,000. Requirements for approval include having a checking account, a regular income source, and valid identification. Understanding cost, eligibility criteria, and other factors influencing payday loan size, borrowers make informed decisions about financing needs and use payday loans responsibly.

The symbolism in Rixloan’s situation is hope; despite potentially high costs associated with payday loans, borrowers access funds for unexpected financial emergencies or short-term cash flow problems. For borrowers who need quick access to money and understand their responsibilities as borrowers, payday loan size allows them to bridge any financial gaps until their next paycheck arrives. As long as they know all terms before getting a loan and follow responsible borrowing practices afterward, they borrow benefits from Rixloans services without falling into unmanageable debt cycles.

Payday loans are unsuitable solutions for long-term financial difficulties and help cover temporary expenses if used appropriately. Potential borrowers must assess all aspects of such products before deciding how much credit they get. Borrowers must aim to keep their total debt levels low so that repayment remains manageable regardless of what life throws at them financially.

Frequently Asked Questions

What is the average payday loan amount in the United States?

The average payday loan amount in the US is around $375, with loan sizes ranging from $50 to $1,000 depending on state laws and individual lender policies.

How does the typical payday loan size vary by state?

Payday loan sizes vary widely by state, with states like California and New Mexico allowing loans up to $300, while states like Idaho, Utah and Delaware allow loans up to $1000 under certain conditions.

Are there any regulations that govern the maximum payday loan amount in the US?

Yes, many states have caps on payday loan amounts, such as $500 in Florida and $300 in California. However, some states have no limits, and the federal government does not currently regulate maximum payday loan amounts.

What factors can influence the size of a payday loan a borrower can get?

Factors like state laws, lender policies, borrower income and credit history can all influence the size of the payday loan a borrower can obtain. Higher incomes may qualify borrowers for larger loans.