The easiest and most convenient way of owning the car of your dreams is through Rixloans. Applying for Rixloans loans is easy, and any credit type can qualify.

You may have a bad credit history but desperately need a bad credit car loan. We work with people who have the same issue every day, and they always walk away with a car loan, no matter how poor their credit scores are.

A chance to own a car that you have always wanted is here. Our auto loan approvals are made online. Otherwise, you can give us a call.

Which model do you prefer?

Owning a car indicates you are on the right path to financial freedom. You only need to decide which car to choose. We work with a large network of car dealers that can offer any vehicle you need, from economy cars to performance cars or even luxury SUVs.

Before choosing a car dealership, you need to consider important factors. For instance, you can ask these questions.

Which company offers instant financing?

Rixloans, of course, will ensure the funds are approved as soon as you need them.

Which company works with poor or no credit applicants?

We can also help you out.

Ask us any questions concerning our loans, and we can guarantee a timely response. Besides, our repayment terms are personalized to ensure you can comfortably pay the debt. For these reasons, we are on the list of the best companies for bad credit car loans in the United States.

Work With One of Our Reputable Dealers

Finding a reputable and reliable dealer is the most important thing when looking for car loans with bad credit. Rixloans is willing to go through this process that would otherwise be difficult if you need help knowing where to start.

Our dedicated customer service team can go the extra mile to ensure you get the necessary auto financing. We ensure that our customers’ experiences are smooth when looking for bad credit car loans. With us, you can get the auto loan and buy your dream car quickly. We also work with a large network of car dealers willing to finance people with bad credit.

Bad Credit Auto Loans

We take pride in helping consumers get auto financing when their loan requests are turned down elsewhere. What makes us unique is that you can apply and qualify for a car loan for bad credit today! Most importantly, we offer credit to people with no or low credit history.

We aim to ensure each consumer can get auto financing for a car purchase. And with our loans, it is also easier to build credit and qualify for affordable financing in the future. You only need to visit our website and complete your bad credit car loan application. After this, your loan will only be a click away.

Are you tired of moving from one bank to another for your auto loan application to be approved? Do you need more credit scores to qualify for a car loan? Don’t despair. Rixloans is ready to provide your finances for your first or next car. We will answer all your questions concerning our bad credit car loans and ensure you get the finances on time.

Apply for Bad Credit Car Loans Today

You might have been in a tough financial situation contributing to poor credit. Don’t worry. Rixloans works with people with bad credit scores, repossession, and bankruptcy history.

People in any of these categories can still qualify for a car loan and own the vehicle of their dreams. This is another reason why we stand out in the car financing industry. With us, you can qualify for auto financing regardless of the mistakes you made in the past that affected your credit profile.

The current statistics indicate that about a third of residents in the United States have a bad credit score (basically a credit score of less than 601).

This gives you a clear picture of the situation; when it comes to bad credit, you are definitely with others. A good number of Americans suffer from bad credit, and as a result, they go for bad credit car loans to help them with car purchases.

We have been in the industry for over 20 years, helping people with bad credit get the necessary financing. And we will continue to do so no matter how difficult the situation.

We know how stressful it is to purchase a car, and if you do not work with the right credit car loan providers, the whole process can be a mess. This is exactly why we are in the industry; to offer bad credit auto financing to people who need it.

Requirements for Bad Credit Car Loans

When approving loan requests for bad credit car loans, the main requirement is to have a reliable income source. To qualify for auto financing with us, you first need to have a reliable source of income. We will use a poor credit loan calculator to determine how much you pre-qualify depending on your financial status.

How Bad Credit Loans Work

The first step to getting a car loan for bad credit is submitting an online application. In this case, you must show income proof and a pay stub. You also have to show proof of residence as a receipt for utility bills. As one of the leading credit car loan providers, we aim to make this process as smooth as possible.

Next, we will run your credit to determine your financial situation and present you with various auto financing options. When completing the loan application, you must provide five personal references. You have to provide the full names and addresses of all these people. Proof of insurance is also required.

Lastly, you must show proof of identity by issuing a copy of your driver’s license.

Why You Should Drive Your Car

Using a safe and reliable source of transport is more convenient. Once you are pre-approved for auto financing through auto loan companies like Rixloans, you are just a few steps away from owning a car. Rixloans makes the car financing process smooth and straightforward with an easy online application process. We are among the top auto financing companies and are proud to see our customers drive away with brand-new cars. This is the same thing we want to see with you.

And you may only notice how essential a car is if you are in a tough or awkward situation. For instance, you may get late for work when using public transport, or an emergency happens in a different location that needs to be attended to immediately. This will fuel your desire to apply for a bad credit car loan so you can travel anywhere, whether late or early. This is also another advantage of our bad credit car loans.

The Issue of Downpayment

You might need more money to purchase a vehicle in cash. But once you make a down payment, be confident that you will be a car owner soon. A down payment increases your chances of getting approved for an approval car loan for bad credit.

Applying for a bad credit car loan with no money can be a gamble; you may get it or not. But if you put some money as a down payment, it will improve your chances of approval car loan.

Our repayment options are flexible enough for you to pay in installments. With our bad credit car loans, you can own any vehicle you want, whether a car, van, truck, or any other automobile.

Purchase Your Dream Car With Auto Loans for Bad Credit

People with bad credit and those who recently filed for bankruptcy can now buy a car. This is attributed to the availability of bad credit auto loans. Bad credit car loans are cash advances solely used to buy a vehicle. The loans can be used to purchase any automobile, be it a car, vehicle, van, or truck.

Bad credit car loans are paid in fixed installments until the term ends. Do not shy away from applying for bad credit car loans. Once you decide that owning a car is the best thing to do, you are on the right path to improving your life.

Benefits of Applying for Bad Credit Car Loans

- People with any credit type can qualify

- The application process is fast, easy, and straightforward

- It is now easier to apply for bad credit car loans compared to the past

- Flexible payment terms and long repayment duration

- Effective and friendly customer service that can help you through the process of applying for bad credit car loans

- No hidden charges

- Affordable interest rates

- The fast and easy application process

Our car loans for bad credit are designed so that you can apply and qualify for the loan even at home. We have effective customer service that can review your loan application for bad credit auto loans anytime.

You can get a smooth and hassle-free experience whenever you apply for a current car loan with us. Thanks to our fast and easy application process, getting the car you want only takes a little time. We also have fewer requirements that most people can meet.

Over 30 000 dealers

Once you apply and qualify for a car loan with us, we will ensure you get a car that meets your needs and preference. Rixloans works with a large number of car dealers across the United States. As a top auto loan lender, if you want a specific car, we will ensure that we find a dealer who can offer it from our top car dealers.

We have helped millions of car dealers with specific requirements to get a car that suits them best. And the fact that we work with bad credit lenders also makes things easier. No matter how unique you want the car to be, we will ensure you find it. Trust us for your car needs and get approved for a bad credit car loan in minutes.

Requirements for Used-Car Loans and Bad Credit Car Loans

Getting a car with the help of Rixloans has been easier than ever before. However, there are some requirements that you have to meet to benefit from our products and service. We aim to help more and more people who need a car to get a bad credit car loan or used-car loans. Here are some of the things you need to have when applying for our car loans;

- A government-issued ID card (we won’t ask for a social security number)

- Proof of income

- Permission to ensure the vehicle

- five personal references

- Commitment to purchase an automobile from any of our 30,000-plus authorized dealers

- You may also need to file a credit application

Buy a Used or New Car With Bad Credit Car Loans or Used-Car Loans

Rixloans will help you get the financing for a new or used car through a smooth and straightforward process. We don’t care whether you have been through repossession or bankruptcy. And whether you were denied an auto loan request from other Auto loan providers also doesn’t matter to us. We will still connect you with a car dealer willing to finance your car, even for Bad credit borrowers.

Once you meet our requirements, qualifying for a car loan with us will be much easier. We will make it easier for you to buy a car regardless of whether it is new or used. Buying a car, van, or truck with us is a smooth and unforgettable experience. Our loans are also designed to help your unique needs. And you can still qualify whether you have a poor or no credit history.

Getting a Car Loan With Bad Credit-3 Simple Steps

You might be wondering how possible it is to get a car loan if you need better credit. The first step is to approve your auto loan request form. After meeting our requirements, the next step will be easy.

Step 1

Submit an online application. Once we get this application form, it will indicate that you are interested in our auto loan for bad credit. It does not matter how bad your credit score is. You only have to apply and leave the rest to us, including finding the best auto loan rates for your situation.

At this stage, there are some questions that you will be asked. Ensure you answer since your response will determine your best loan option and auto loan rates.

Step 2

This is the preapproval stage. You can visit one of our recommended dealerships and choose your preferred car at this stage. Our dealerships offer high-quality vehicles, and finding one that suits you best is easy. Remember that your pre-approved auto loan rates might affect the total cost of your vehicle.

Step 3

This is the stage where you can access the car. You need to confirm if this is the same car you need. Once everything is settled, we will finalize your loan agreement, including your auto loan rates.

No Credit, Bad Credit, Poor Credit, or Excellent Credit Can Apply

When applying for a traditional car loan, one of the main requirements is a good credit score. So if you have bad credit, your chances of qualifying for the loan are minimal. Regarding Rixloans, we will ensure you get the best bad credit car loan you can ever find. When you come across the term vehicle financing, know that we are the leaders in the industry.

Traditional financial institutions list a good credit score as one of their approval requirements. But we are the opposite. We aim to ensure that people with less-than-perfect credit scores can also own the vehicles of their dreams. We won’t discriminate against you just because you don’t have a fico score of 700 or higher. We specialize in auto loan refinancing for those with less-than-perfect credit, making it easier for them to manage their car loans and improve their financial well-being.

People with bad credit enjoy the same privileges as those with excellent credit. You can even qualify for low APR and flexible repayments even with a bad credit score. Applicants with bad credit can qualify for a car loan of up to $200,000. Just because you have bad credit doesn’t mean you can’t enjoy life’s luxuries, like owning the latest car model. So if you have bad credit, come to us, and we will ensure you are pre-approved for a car loan with attractive loan offers.

Easy and Fast Car Loan Financing for Bad Credit

Our loans are available for both new and used cars. We offer the lowest rates, and applying for our bad credit car loans is easy. Visit our website and submit your application. After this, we will ensure you get the best car loan with favorable auto loan terms. No matter your credit score, you can still qualify for our car loans if you meet the Minimum credit score requirements. We will connect you with a reputable dealer ready and willing to finance your next car purchase.

What Is a Credit Score?

Knowing your credit score and the steps that can help improve your credit. This is a three-digit number that the lender uses to determine your creditworthiness. This is an important factor that determines how easy or difficult it is to qualify for a loan. That aside, you can still qualify for car loans even with a bad credit score.

Can I Get a Car Loan With Bad Credit?

Definitely. Regardless of your credit score, it would help never to let it define you. Instead, make it an opportunity to improve your financial situation. Lenders will review your credit score when approving your bad credit car loan. Here is a representation of how fico scores are;

800 – 850: Excellent

740 – 799: Very Good

670 – 739: Good

580 – 669: Fair

300 – 579: Poor

Not all lenders use the same scoring model; other factors are also considered, like your income, for instance, and calculating individual credit scores.

Can I Get a Car Loan With a Credit Score of Less Than 600?

Many bad credit car loan options are available for people with bad credit. Besides, the loans can also help rebuild your credit score if you make payments on time and full payments. It is even possible to buy a car online with bad credit.

Remember that the financial situation varies among people. Lenders also have different criteria to determine whether you can qualify for a car loan with bad credit. Rixloans is also the same, but a credit score isn’t one of these factors.

Be proud of owning a car by applying for our bad credit car loans now. This is a step to achieving financial freedom; you can even travel to places you have never been. It is all on you to decide which car you like and whether you can afford to make the loan payments and affordable payments.

Do you need a car loan as soon as today? Contact us for help

$500 Down Payment for Bad Credit Car Loans

You might be tempted to assume that there are limited financing options for people with bad credit. If you are a low-income earner, you can still qualify for a car loan by putting in $500 as a down payment. Applicants with low credit scores can also do the same.

This may be true when it comes to banks and credit unions. But with us, we can guarantee a bad credit car loan for a quality car. You can even get a car with as little as $500 money down. However, you may have to purchase a used car in this case due to the following;

- You can qualify for a lower loan amount

- Lower monthly payment

- Lower interest rate

Bad Credit Loans, No Down Payment

Bad credit auto loans can be a challenge. You can easily apply and qualify for our bad credit car loans. When looking for a car with bad credit, you should also be sure what you want.

Knowing where you stand regarding finances and credit will also help you make wise decisions when choosing a car. If your credit score is lower than 599, you may pay up to five times more than those with a good credit score. This is due to the minimum credit score requirements for better auto loan terms.

But if you put a down payment of as little as $500, getting an auto loan with better terms will be easy, even if you have to deal with a higher auto loan payment.

- Apply and get preapproval for a bad credit car loan today

- We will connect you to a reputable dealer within your state

- Sign the paperwork, and the car is all yours

A Larger Down Payment Means Low Interest and a Short Repayment Period

One way to easily get a car loan with flexible terms is by making a large down payment. If you put as little as $500 money down, you will increase your chances of approval. But with a higher down payment, you can also benefit from low-interest rates and short repayment terms, leading to a more manageable auto loan payment. This is why people with bad credit are advised to make a large down payment to meet the minimum credit score requirements.

Apply for a Bad Credit Car Loan and Improve Your Credit Score

You can indeed qualify for an auto loan with bad credit. Still, you must come up with ways to improve your credit score. To start, ensure that all your outstanding debts are paid.

Pay more than the minimum monthly every month. And with the car loan, you should avoid making late payments. Remember to compare options from different lenders once you are ready to look for a car with bad credit.

A small difference in interest for car loans with bad credit can be a significant amount eventually. The reason for this is to get a dealer with low-interest rates. This also applies when refinancing the car.

Tips for Improving Your Credit Score

As stated, improving your credit score by applying for our bad credit car loans is possible. With time, the loan will help rebuild your credit.

Can you improve your score once you qualify for a bad credit car loan? This is true, although it requires time, patience, and financial awareness. Here are some of the reasons why our loans can help you;

- Applying for a car loan for bad credit will add an entry to your credit history. Like credit cards, a bad credit auto loan will also appear on your credit report. This additional entry is important, especially when you are starting to build your credit. Understanding how loans to borrowers with bad credit work and using an auto loan calculator to estimate your monthly payments is essential.

- After qualifying for a car loan, you can choose terms that suit you best. Use this chance to make more than the minimum amount. Paying the loan early is good for your credit score. However, this can only apply when the dealer does not charge prepayment penalties on loans to borrowers.

- With our auto loans for bad credit, you can own a car when everyone else says no. And with the car, you can also get a title loan when you get a financial emergency. This can also add marks to your credit if you pay on time. Using an auto loan calculator can help manage the repayment process efficiently.

Bad Credit Car Loan Calculator

Before applying for a car loan, using a bad credit score calculator is important to determine the maximum amount you can qualify for depending on your credit score.

Here is what you need to know to calculate the total cost of borrowing, considering factors such as payment history and the potential impact on borrowers with credit scores. Our car loan calculator lets you know how the loan interest rate will affect the loan term. You will also know how much your car of choice costs and whether you can afford to make the payments.

Bad Credit Car Loan Amount, Interest, and APR

- The loan amount is the principal car loan amount that you borrow

- The loan term is the duration that the car loan will be paid for. This can be several years, depending on the principal amount.

- Annual percentage rate, APR

After you estimate how much you need to spend on a car, it will be easier to find the right one depending on your needs and budget. This is because you will know how much the deal will cost. It will also make it easier to apply for instant approval auto loan from us, either online or in person.

Best Car Loan for Bad Credit in the United States

Rixloans does its best to ensure you get the car loan you need. Our knowledgeable staff will guide you through finding a car that fits your budget and discussing Auto loan options. We will ensure we go through the entire paperwork before getting loan approval. We aim to ensure you know what you are getting into with no hidden agenda whatsoever, especially for buyers with auto financing.

To get more information concerning our car loans, please go through our blog section on the website. You will also get information on saving money after applying for our bad credit car loans.

Bad Credit Car Loan Lenders Near Me

We look forward to approving your application for a car loan with bad credit. We not only offer loans at affordable rates, but the repayment is also manageable. Our rates are among the best you can find around. We have multiple locations across the United States. With our friendly customer service, you can also be sure of getting the best services.

If you have ever wondered if there are bad credit car loans near me, know you can find one. At Rixloans, we have locations in different parts of the country, and the fact that we work with over 30,000 dealers will also make it easier to get the car you need.

Work With One of Our Top Dealers

Regardless of how your credit score is, look no further. Rixloans works with thousands of dealers all over the United States. With them, finding a used or new car will be easier than ever before. We are here to ensure that you get the best experience when buying a car.

No matter your question concerning our car loans for bad credit, we will ensure that you get the right response with our competitive rates and vehicle requirements in mind. We will ensure you contact one of our reputable dealers and drive your dream car as soon as possible. For any further inquiries about vehicle requirements, don’t hesitate to ask.

Frequently Asked Questions

What are the current interest rates for bad credit car loans in 2023?

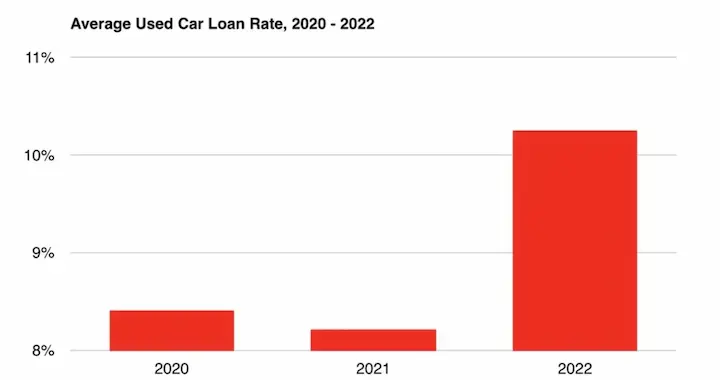

In 2023, interest rates for bad credit car loans typically range from 8% to 30%, depending on factors like credit score, loan amount, and lender. Rates are generally higher than for those with good credit.

How can I improve my chances of getting approved for a bad credit car loan this year?

You can improve approval odds for a 2023 bad credit car loan by paying down debts, avoiding new credit inquiries, having a steady income, providing a large down payment, using collateral, and applying with subprime lenders that specialize in bad credit.

What is the minimum credit score required to qualify for a bad credit car loan in 2023?

Most lenders require a minimum credit score between 500 and 600 to qualify for a bad credit car loan in 2023, but each lender sets their own requirements. Scores under 600 are generally considered bad credit.

Are there any government programs or initiatives in 2023 that can assist individuals with bad credit in securing car loans?

Unfortunately there are no specific government programs for bad credit car loans in 2023, but some state and local programs may offer assistance on down payments or interest rates for qualifying borrowers.